- GBP/USD is firming from near two-month lows.

- Overhead resistance has a confluence with a 50% mean reversion target.

At the time of writing, GBP/USD is 0.1%, currently trading at 1.3748 having travelled between a low of 1.3694 and a high of 1.3768.

GBP/USD was lower by 1% last week as Britain proposed to use alternatives to the Oxford-AstraZeneca COVID-19 vaccine to inoculate people aged under 30.

At the start of the week, sterling has stayed near to a two-month low against the US dollar following the first round of key US data for the week.

The Consumer Price Index jumped 0.6% last month, the largest gain since August 2012, after rising 0.4% in February, the Labor Department said on Tuesday.

Excluding the volatile food and energy components, the CPI rose 0.3%. The so-called core CPI nudged up 0.1% in February.

The dollar was firm on the release but then dumped to three-week lows as it was soon realised that it was immaterial with respect to the Federal Reserve’s commitment to keeping interest rates at rock-bottom levels for years to come.

US Treasury yields also fell after the data.

The next major US economic release will be the Retail Sales data for March on Thursday.

Meanwhile, the pound has been trading heavy since the Bank of England said its chief economist Haldane, one of the more hawkish figures, will leave the central bank later this year.

Haldane has been the most upbeat member of the BoE’s Monetary Policy Committee on prospects for a sharp economic recovery from the COVID-19 pandemic and in February likened inflation to a tiger that could easily be roused.

Interest rate futures were still showing that there are expectations that the BoE will keep rates unchanged until mid-2022.

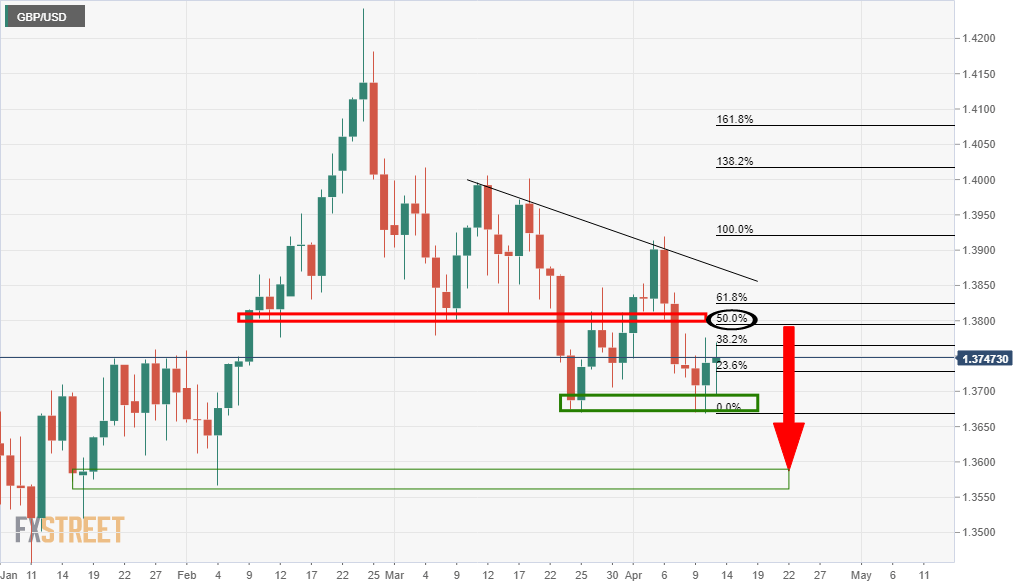

GBP/USD technical analysis

The price has been rejected at the daily support and could be on the verge of a test the prior lows that would be expected to act as resistance in a 50% mean reversion of the latest bearish impulse.

A failure there would be presumed to lead to a downside extension to a deeper layer of support.