- Sterling trading in a sideways pattern ahead of Thursday’s BoE release.

- Brexit has taken a backseat for this week with central bank action on the cards, but August will see the EU and the UK return to the negotiating table.

The GBP/USD is testing just above 1.3100, cycling around the technical level as the new week opens on a quiet note with plenty of central bank action on the docket.

Brexit negotiations are set to resume in mid-August with the UK’s Prime Minister Theresa May at the helm of negotiations after the PM’s latest Brexit proposal was flat-out rejected by the European Union following heavy editing in the UK’s parliament by determined leavers in the British government, and PM May has taken over control of trade talks in an effort to head of Brexiteers forcing the UK into a hard-Brexit scenario by continuing to fail to reach feasible trade deals with the EU.

The Bank of England (BoE) is also slated for a hectic Thursday window this week, and Brexit is on the back burner as traders await a 25 bps increase from the UK’s central bank; the GBP/USD has hit a technical bottom against the US Dollar in the run-up to the BoE showing this week, and a failure to raise rates as expected on Thursday could see the Sterling slumping back towards new lows for 2018.

Monday sees a slow start however, with only the GFK Consumer Sentiment indicator expected for the GBP later on in the day at 23:01 GMT. The sentiment indicator is expected to hold steady at -9, a bearish reading.

GBP/USD Technical Analysis

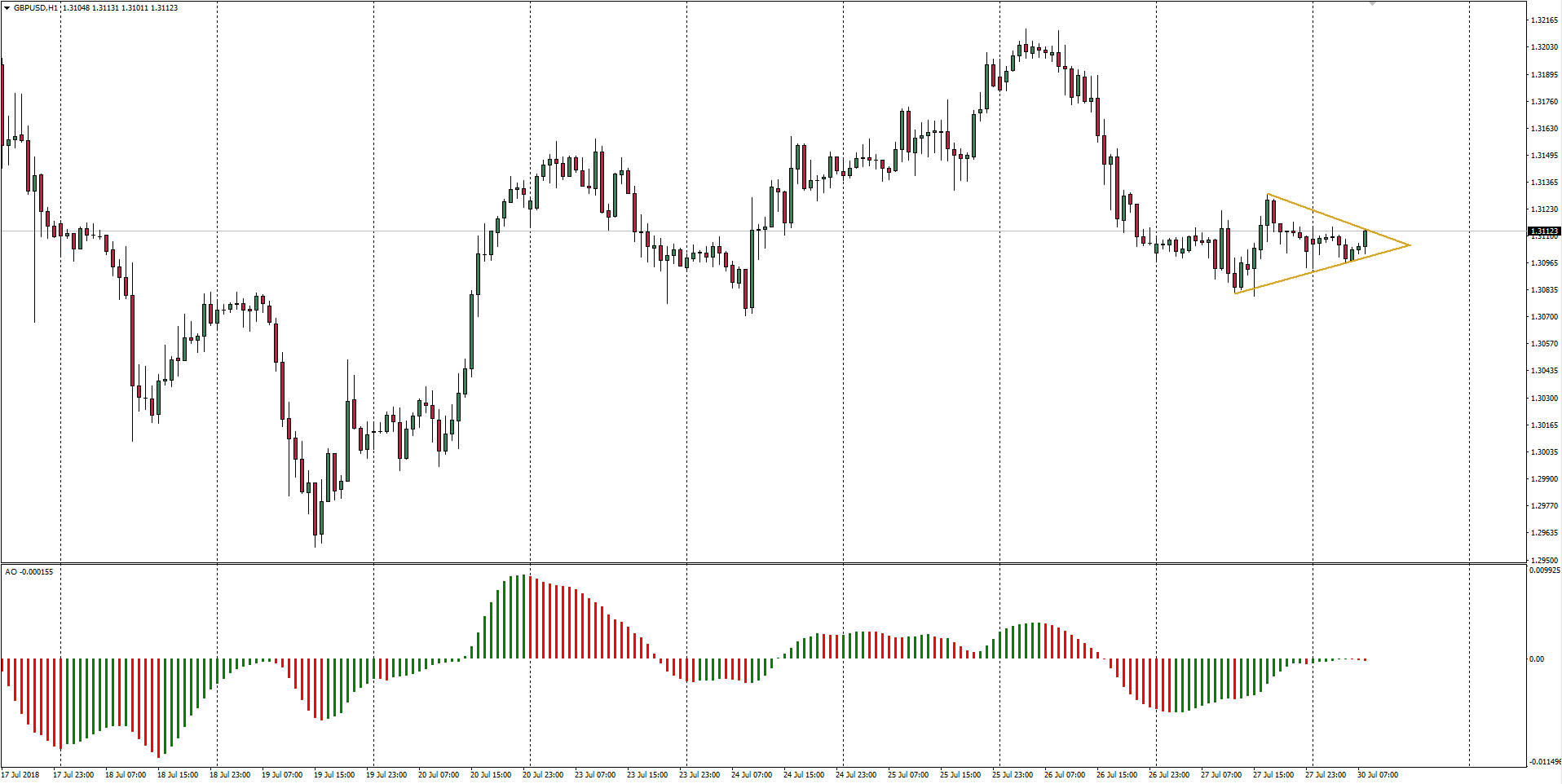

Hourly candles have the Sterling in a bearish pennant pattern, and a downside snap will see the pair challenging the 1.30 technical level, though a break to the upside could quickly erase the pennant pattern.

GBP/USD Chart, 1-Hour

| Spot rate: | 1.3112 |

| Relative change: | 0.03% |

| High: | 1.3114 |

| Low: | 1.3094 |

| Trend: | Flat |

| Support 1: | 1.3082 (Friday’s doji candle low) |

| Support 2: | 1.3049 (June 28th swing low) |

| Support 3: | 1.2957 (July 19th low) |

| Resistance 1: | 1.3130 (5-day MA) |

| Resistance 2: | 1.3213 (Thursday high) |

| Resistance 3: | 1.3241 (50-day MA) |