- Sterling is exposing its weak points as Brexit continues to drag on GBP buyers.

- Tuesday brings the UK’s first-ever GDP monthly reading, and market reaction could get wonky.

The GBP/USD pairing is weakening further heading into Tuesday’s London market session, touching into 1.3230.

Brexit concerns are once again at the forefront for the Sterling, and Prime Minister May’s latest “third option” Brexit proposal has seen the UK’s cabinet fracture, with five key members of the Brexit cabinet resigning from their positions in protest over the PM’s latest proposal, which fails to make either side of the Brexit negotiations happy.

Tuesday will also be bringing a dose of macro data for the UK, though traders will largely be focusing on the key headline number: Britain’s first monthly GDP indicator, dropping at 08:30 GMT, and expected to print at 0.3%. This will be the first-ever reading of the UK’s monthly GDP indicator, and market reaction is expected to be irregular as traders react to the new data flow.

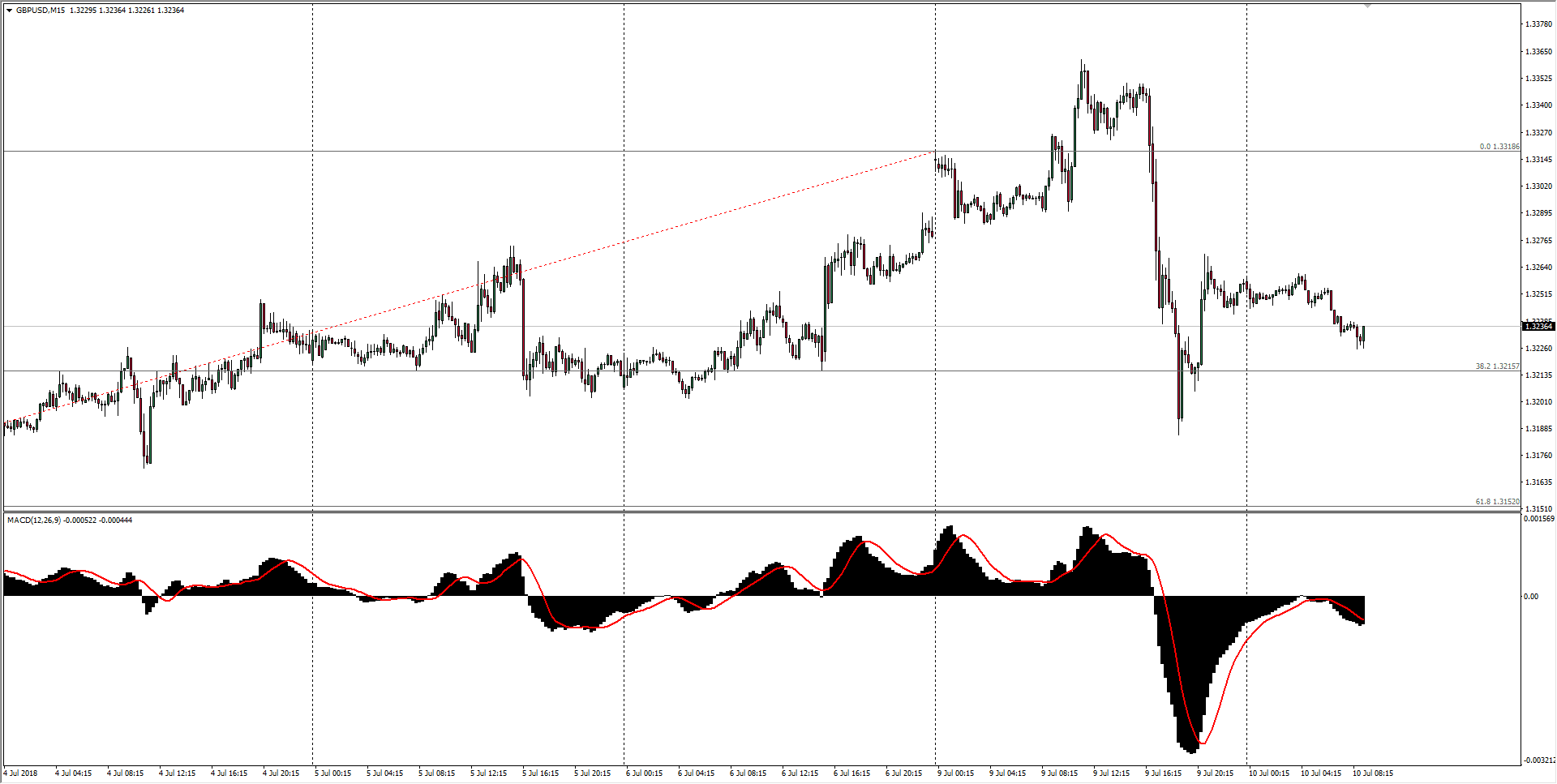

GBP/USD Technical Analysis

The GBP/USD’s price action is being dominated by Brexit headlines which broke on Monday and have continued to seep into the Sterling’s chart action. The pair initially dropped into 1.3180 in Monday’s London markets, but found support from the key 1.3250 barrier. The last bounce from June 28th could form into a bear flag is bulls don’t manage to push the pair above Monday’s high soon.

| Spot rate: | 1.3236 |

| Relative change: | -0.20% |

| High: | 1.3261 |

| Low: | 1.3225 |

| Trend: | Sideways to bearish |

| Support 1: | 1.3200 (Round number, key technical barrier) |

| Support 2: | 1.3155 (Previous breakout zone) |

| Support 3: | 1.3100 (round number figure) |

| Resistance 1: | 1.3300 (Previous swing high, round number figure) |

| Resistance 2: | 1.3350 (Key technical barrier) |

| Resistance 3: | 1.3472 (June swing high) |