- GBP on the defensive ahead of UK Retail Sales, which are expected to miss the mark broadly.

- Brexit headlines have been forgotten for the time being, but a lack of cohesive momentum from the UK’s parliament will help to keep a weak point in the GBP/USD priced in.

The GBP/USD is trading down into 1.3060 ahead of a Thursday session that will see Retail Sales figures for the Uk, which are already anticipated by market participants to come in on the soft side.

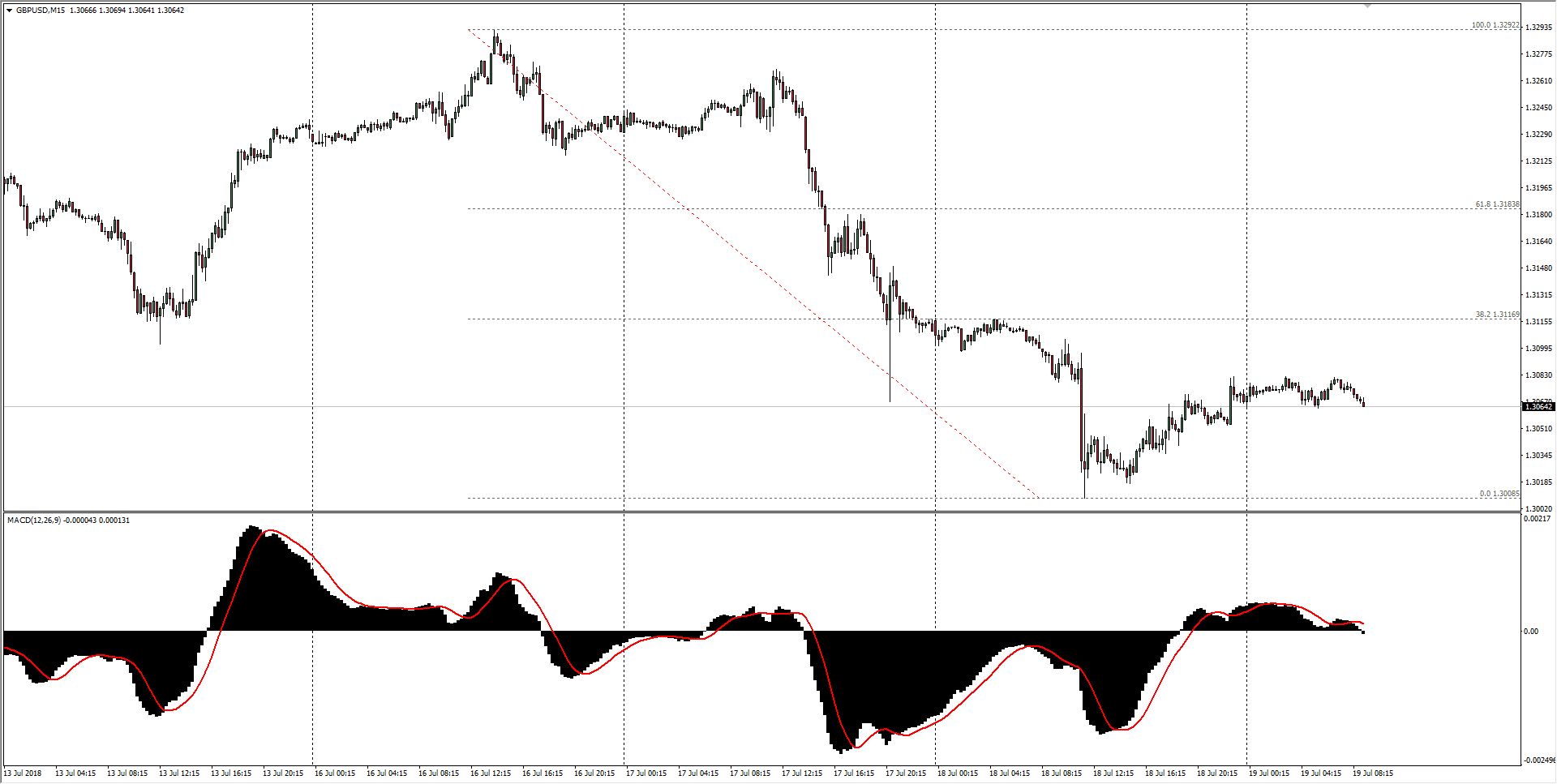

The Sterling has seen steady declines this week, down from an early high of 1.3292, and the pair is now set to challenge current lows at 1.3008, a nine-month bottom for the Pound-Dollar pair.

After steady declines on continued Brexit angst with no end in sight, and a missed inflation reading on Wednesday with the UK’s core CPI for June dropping to 1.9% on an annual basis, the way has been paved for Sterling bears to once again drag the GBP/USD lower, with UK Retail Sales due at 08:30 GMT, and the m/m June Retail Sales are forecast to clock in at just 0.4%, versus the previous period’s 1.3%. Market analysts may have overshot their bearish calls on retail sales figures for the month, and a positive printing may find just enough buyer support to halt the major pair’s decline, even if the printed number fails to make headway over the previous figure. On the downside, A clear flub of the anticipated reading will easily see the GBP/USD mark out fresh lows below the critical 1.3000 major barrier, opening the way up for furthe downside.

GBP/USD Technical Analysis

With the Sterling trapped near nine-month lows on Brexit concerns and middling-to-disappointing economic indicators for the UK’s economy, a bad pull on the Retail Sales is the last push bears need to take the pair lower, but a positive reading could see a much-needed floor put in under the battered bulls. The GBP/USD’s Daily chart shows the major pair in a firm downtrend, and sellers will maintain the upper hand until a new high can be broken into.

| Spot rate: | 1.3064 |

| Relative change: | -0.05% |

| High: | 1.3082 |

| Low: | 1.3063 |

| Trend: | Bearish |

| Support 1: | 1.3049 (June low) |

| Support 2: | 1.3008 (current week low; critical technical bottom) |

| Support 3: | 1.2950 (S2 daily pivot) |

| Resistance 1: | 1.3116 (previous day high) |

| Resistance 2: | 1.3183 (61.8% Fibo retracement level) |

| Resistance 3: | 1.3292 (current week high) |