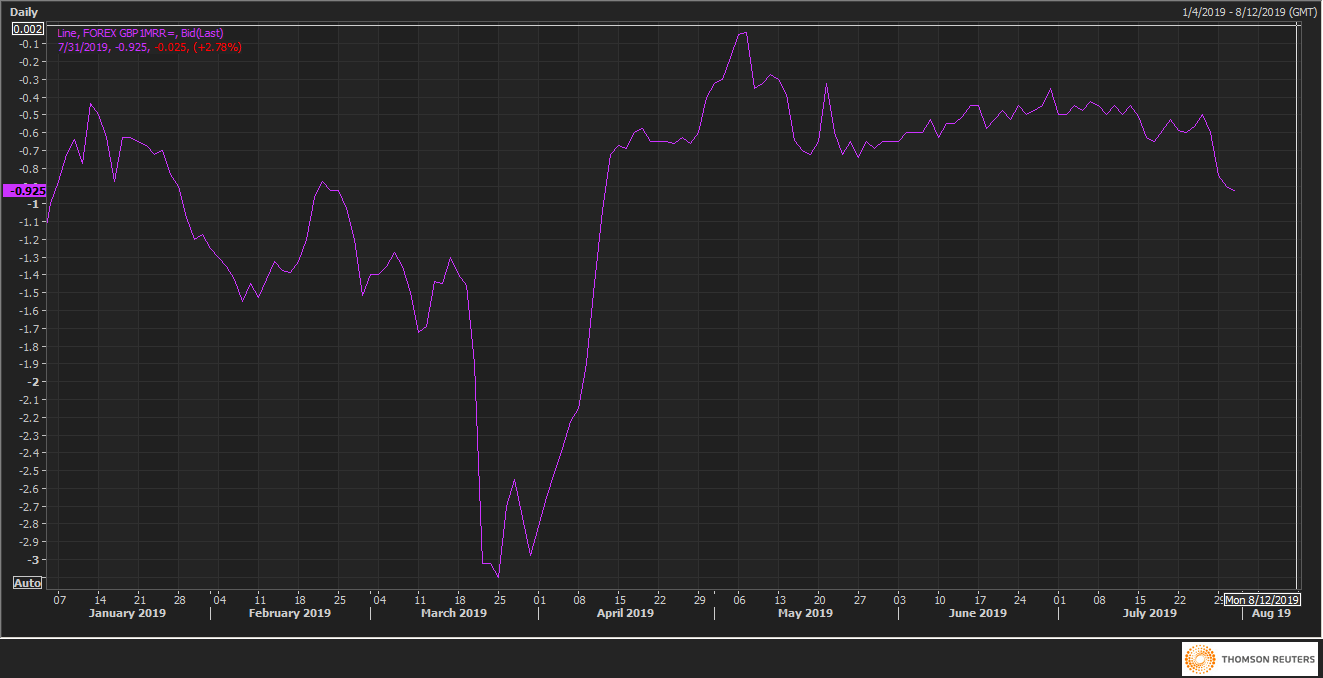

- GBP/USD one-month risk reversals have hit the lowest level since April.

- The slide in the risk reversals indicates increased demand for put options.

One-month risk reversals on Sterling (GBP1MRR), a gauge on calls to puts on the common currency, fell to the lowest level since mid-April on Wednesday, indicating the investors are adding bets to position for weakness in the British Pound.

The gauge fell to -0.925, the lowest level since April 11, having topped out at -0.50 six days ago.

The negative number indicates the implied volatility premium for the GBP put options (bearish bets) is higher than that for the GBP call options (bullish bets).

The GBP/USD pair is currently trading at 1.2153, having dropped in the previous four trading days. As of writing, the pair is down 1.83% on a week-to-date basis.