- GBP/USD risk reversals dropped to two-week lows on Tuesday.

- Put options have gained sharp value amid Brexit uncertainty.

The value of GBP/USD put options or bearish bets has increased sharply in the last seven days, meaning the investors are prepared for a deeper drop in Sterling due to Brexit uncertainty.

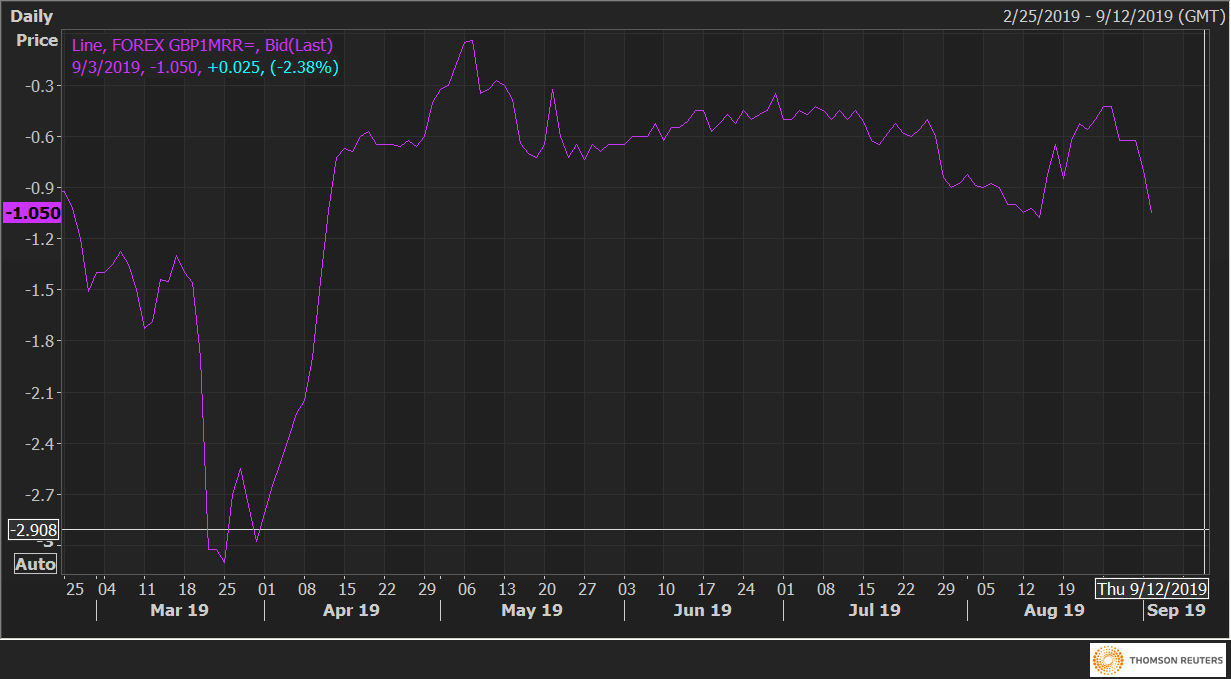

The one-month 25 delta risk reversals (GBP1MRR), a gauge of calls to puts on the GBP, fell to -1.05 on Tuesday, the lowest level since Aug. 15, having topped out at -0.425 on Aug. 27.

The negative print indicates the implied volatility premium for the GBP puts is higher than that for calls. So, the slide from -0.425 to -1.05 represents an increase in demand for the GBP put options.

GBP/USD fell to 1.1958 on Tuesday – the lowest level since October 2016 – as British Prime Minister Boris Johnson threatened to call a snap election to push through Brexit.