- GBP/USD has been declining as US yields are on the rise.

- Responses to UK GDP, some Brexit woes, US data and stimulus are set to move the currency pair.

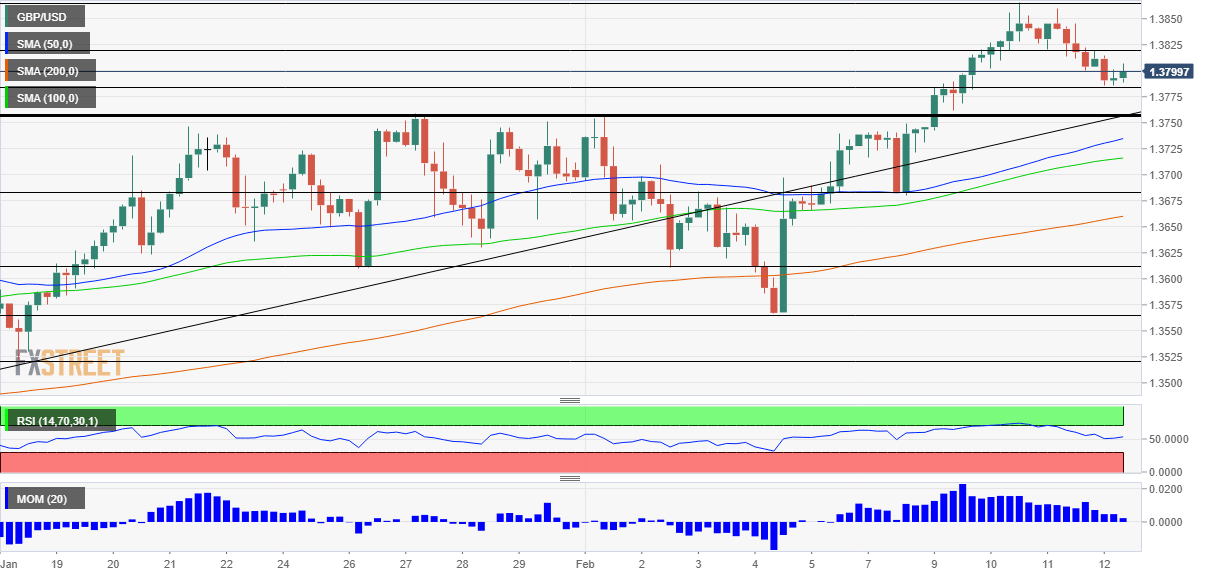

- Friday’s four-hour chart is painting a bullish picture.

Surprise? Not for those listening closely to the Bank of England – the UK has reported that Gross Domestic Product growth rate of 1.2% in the fourth quarter of 2020, beating economists’ consensus, but meeting elevated expectations created by the BOE. The economy withstood November’s nationwide lockdown and Brexit uncertainty and is well-positioend to recover.

Given the BOE’s comments, GBP/USD has responded with a “buy the rumor, sell the fact” response – shrugging off the encouraging GDP figures. Nevertheless, it remains well positioned to rally, as most factors play in its favor.

In the US, lawyers rested their case against former President Donald Trump in the Senate trial and now the defense has the stage. The fascinating drama around the storming of the Capitol by Trump supporters has only one meaning for markets – it draws energy away from fiscal stimulus talks.

House Democrats continue drafting the bill in the background. Without new details – potentially about agreeing for a more generous stimulus – bonds will likely remain bid. In turn, that implies lower yields and pressure on the greenback.

The dollar initially dropped in response to weak US jobless claims, which hit 793,000, the first disappointment in several weeks. The focus on Friday is the University of Michigan’s initial Consumer Sentiment figures for February. Will the greenback respond negatively to another miss? Apart from stimulus speculation, it is essential to remember that Americans enjoy a bank holiday on Monday, and that may result in choppy trading.

See US Michigan Consumer Sentiment February Preview: The ocular proof

Brexit: The UK government’s point man on Brexit, Michael Gove, spoke for three hours with his EU counterpart MaroÅ¡ Å efÄoviÄ to discuss the Northern Ireland protocol – albeit without success. Many traders have been trying to forget about the issue but frictions on several fronts may still drag the pound lower.

All in all, after the correction, there is room for the pound to rise and the dollar to fall.

GBP/USD Technical Analysis

Pound/dollar continues benefiting from upside momentum on the four-hour chart and changes hands above the 50, 100 and 200 Simple Moving Averages. Bulls remain in control.

Some resistance awaits at 1.3820, which supported cable when it traded on higher ground earlier in the day. It is followed by 1.3865, the fresh 2021 peak. Further above, 1.39 and 1.40 await GBP/USD.

Support awaits at 1.3785, the daily low, followed by 1.3750, which was a stubborn cap earlier in January. Further down, 1.3680 and 1.3615 await pound/dollar bears.

More The once and future recovery: Will stimulus prove a springboard or bubble?