- GBP/USD has stabilized amid reports of progress in Brexit talks.

- The surge in coronavirus cases and uncertainty about the US elections are set to push it lower.

- Thursday’s four-hour chart is pointing to the downside.

Brexit breakthrough? The pound has managed to weather the storm and claw onto 1.30 in response to reports that the UK and the EU have made progress on state aid. Negotiators, who have moved from London to Brussels, are reportedly “putting pen to paper” on the sensitive topic of state aid.

The reports are undoubtedly encouraging and justify sterling’s recovery – yet now that it is priced, adverse developments may send GBP/USD lower.

First, Britain and the bloc are still at odds over the politically sensitive topic of fisheries. The minuscule sector in both the UK and France is pressing on politicians to take a tough stance and talks may still result in acrimony.,

Secondly, the northern hemisphere is gripping with a harsh second wave of COVID-19. Both France and Germany announced new national lockdowns on Wednesday, and it seems like a matter of time until others follow. Prime Minister Boris Johnson is under growing pressure to abandon his regional approach and announce nationwide restrictions.

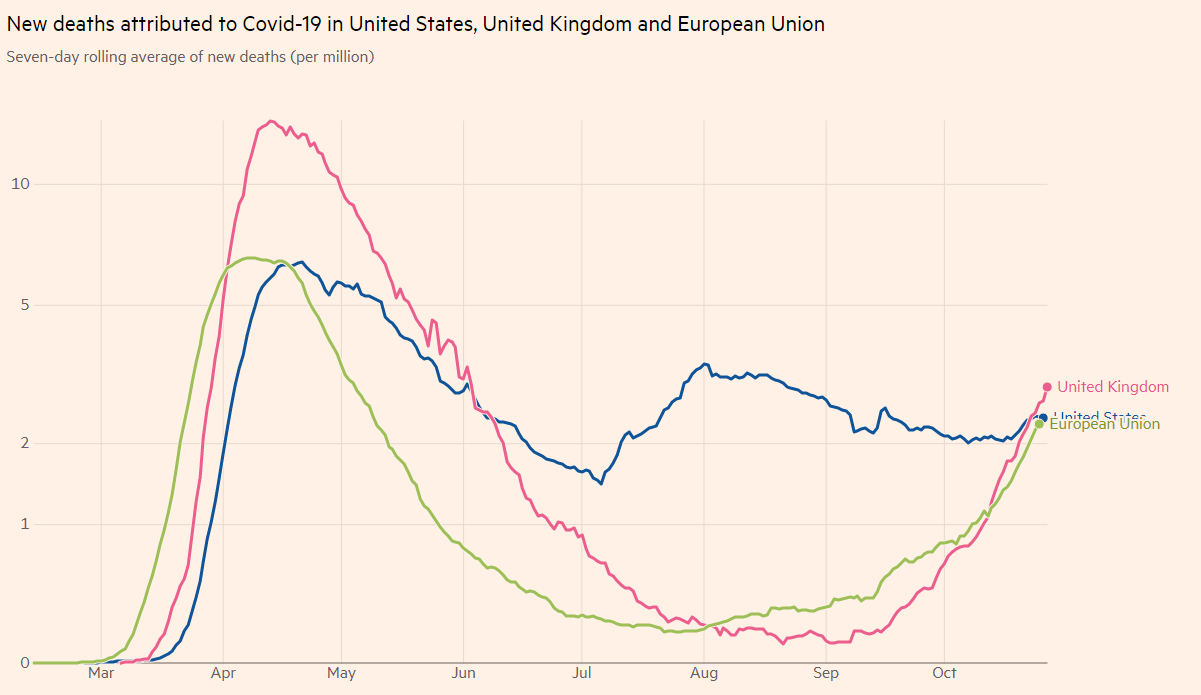

UK covid statistics are breaking records almost on a daily basis. The upcoming publication, due in the afternoon, is set to move the pound. Deaths in Britain are higher than in America and the EU per population:

Source: FT

The third factor comes from the other side of the pond. Tension is mounting ahead of the elections. Despite models pointing to near 90% of a victory for Democrat Joe Biden – and the fact that over 75 million Americans have already cast their ballots – the memory of 2016 is looming.

President Donald Trump may still squeeze a victory or Republicans could cling onto the Senate, preventing a large stimulus package. Moreover, the incumbent refused to commit to accepting the results, raising the chances of a contested election.

Additional opinion polls are awaited on Thursday and could cause the safe-haven dollar to further appreciate in response to fears.

See: How three US election outcomes (and a contested result) could rock the dollar

Election fever overshadows the all-important release of third-quarter Gross Domestic Product data in the US. Economists expect a surge of over 30% annualized, paring most of the collapse seen in the second quarter.

See: US Third Quarter GDP Preview: Must what goes down, come up?

Overall, the recent recovery may be short-lived.

GBP/USD Technical Analysis

Bears remain in control after cable tumbled below the uptrend support line on Wednesday. Moreover, the currency pair failed to recapture the 50 Simple Moving Average on the four-hour chart and momentum remains to the downside.

The round 1.30 level remains a battleground. IT is followed by Wednesday’s swing low of 1.2920, followed by 1.2860.

Resistance is at the daily high of 1.3020, followed by 1.3060 and 1.3080, recent swing highs.