- GBP/USD is holding onto gains triggered by the replacement of the Chancellor of the Exchequer.

- US consumer figures, coronavirus, and Brexit speculation are all eyed.

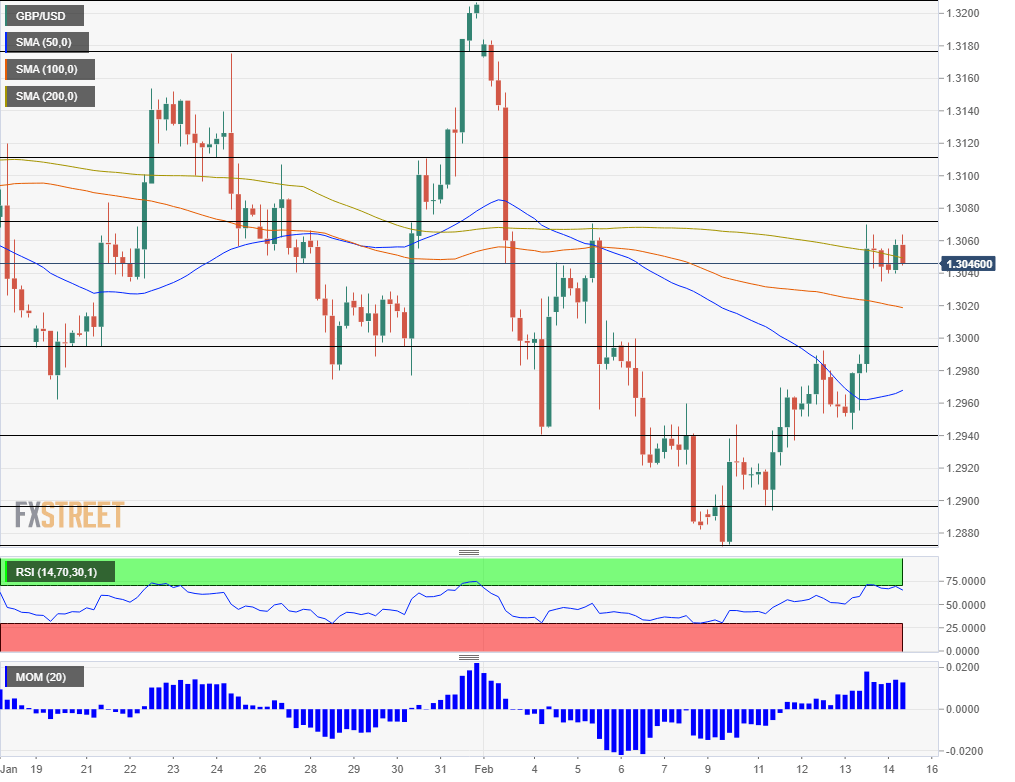

- Friday’s four-hour chart is pointing to an advantage for the bulls.

Bulldozing Boris – Prime Minister Boris Johnson ran down the now former Chancellor of the Exchequer Sajid Javid, making way for Rishi Sunak. More importantly for sterling traders – the change paves the way for infrastructure spending, relieving the Bank of England of the need to provide monetary stimulus.

The new pair on Downing Street – Johnson at No. 10 and Sunak at 11 – will likely scrap deficit obligations set by Javid and increase the debt. British bond yields rose in response, but they remain low and allow London cheap funding for big projects such as the controversial HS2 rail.

Javid tendered his resignation after Johnson demanded that he fire all his advisers, allowing Dominic Cummings – the PM’s powerful aide – to fill in the posts. Some see Sunak as a yes-man and Johnson’s move as a power grab. However, in a world where debt does not matter – as seen in ballooning US obligations – markets are cheering.

The reshuffle also provides a united front ahead of post-Brexit talks with the EU. Both sides have been posturing of late, with traders learning to ignore it. Official negotiations kick off in March and further rhetoric – reflecting the divide on regulatory alignment and other topics – may move the pound.

Coronavirus, US consumer

Will this uptrend continue? Apart from reactions to Thursday’s reshuffle, pound/dollar is facing other significant developments. The coronavirus outbreak remains high in the headlines, with a fresh deceleration in the number of cases, following Thursday’s leap.

Nevertheless, there is significant uncertainty about the economic impact for China – the world’s second-largest economy – and for the rest of the world. Mark Carney, the Governor of the Bank of England, said that it may take one or two quarters to assess the economic impact of the respiratory disease.

Stock markets have remained calm but investors may opt to take profits ahead of the weekend. US shares slid in five of six Fridays so far in 2020. A risk-averse market mood may push the safe-haven dollar higher.

The US consumer may also lend its support to the greenback. Economists expect retail sales figures for January to continue rising. America’s shopping spree has driven the economy forward. Later, the first read of the University of Michigan’s Consumer Sentiment Index is set to remain at high levels near 100 – reflecting optimism.

See:

- Retail Sales Preview: Jobs and consumption are the core of the US economy

- Consumer Sentiment Preview: Looking in the labor market mirror

Overall, echoes from the reshuffling, Brexit, coronavirus, and US data are all in the mix.

GBP/USD Technical Analysis

The four-hour chart provides a favorable outlook for cable bulls. GBP/USD has surpassed the 200 Simple Moving Average, after topping the 50 and 100 SMAs. Momentum is to the upside while the Relative Strength Index is still below 70 – outside overbought conditions.

Resistance awaits at Thursday’s high of 1.3070, which was also a swing high last week. It is followed by 1.3110, a stepping stone on the way up in late January. Further above, 1.3175 and 1.3220 await the currency pair.

Support awaits at 1.2990, which capped sterling on its way up earlier this week. Next, 1.2940 provided support twice in February. 1.2900 and the 2020 low of 1.2875 are next.