- GBP/USD was hit on Monday, with the pair closing the session with losses of around 0.3% or 45 pips.

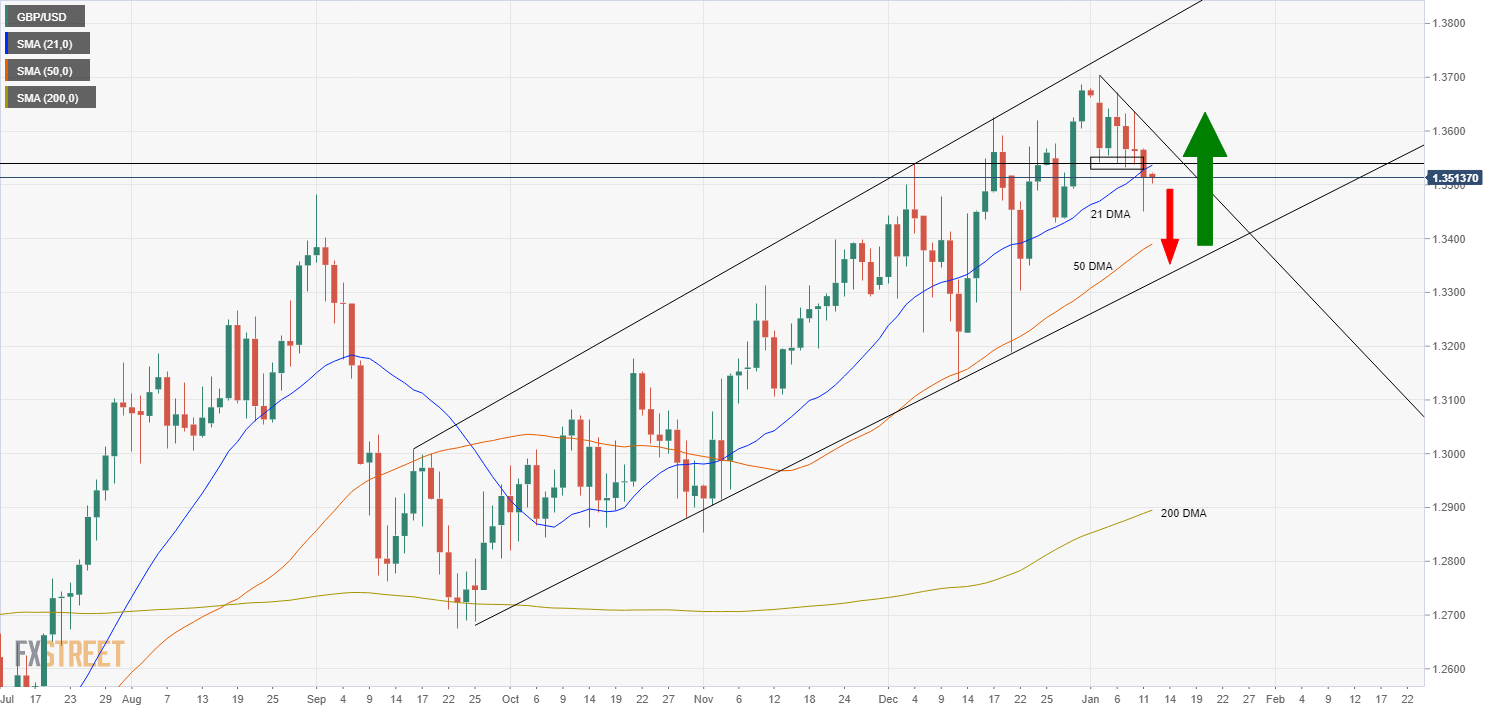

- GBP/USD continues to grind to the north within a long-term upwards trend channel.

GBP/USD was hit on Monday, with the pair closing the session with losses of around 0.3% or 45 pips. USD was stronger against all of its major peers as a result of higher US real and nominal US bond yields, as well as a more defensive feel to trade that saw US equities, crude oil markets and industrial commodities, drop (though most of these risk assets still remain relatively close to recent highs). At present, the pair is trading close to the 1.3500 level; looking at the pair over a four-month horizon, the technical outlook for cable looks bullish.

UK news update

GBP/USD was almost entirely focused today on USD dynamics, falling as low as 1.3450 as the Dollar Index topped out in the 90.70s before recovering to current levels around the 1.3500 level as the Dollar Index dropped from highs back to the 90.40s/90.50s. There are a few UK stories worth noting, however;

Firstly, the UK may be on the verge of irking China, amid reports that the country is to tighten the law on importing goods linked to alleged human rights abuses in China’s Xinjiang region. Foreign Minister Raab is to make a statement in the House of Commons on Tuesday on the matter, which is likely to provoke an angry Chinese response.

Elsewhere, Bank of England Monetary Policy Committee Member was on the wires today; he said it is possible that more stimulus would be needed and that work on the feasibility of negative interest rates is still ongoing. He reiterated his stance that evidence shows that negative rates have worked well in other countries and that in theory, rates could go as low as -0.75%.

Finally, UK Chancellor Sunak who has been under pressure to extend the UK’s furlough scheme beyond April spoke on the economy and the upcoming budget and said that the decisions on future welfare spending and taxes will be made at the budget.

GBP/USD looking bullish on long-termer term horizon

GBP/USD continues to grind to the north within a long-term upwards trend channel. Most relevant for the pair right now is the uptrend support line of this trend channel, which links the September lows, the late-October/early-November lows and then the 11 and 21 December lows. A test of this uptrend would likely require a move below 1.3400 and the pair’s 50-day moving average at around 1.3390. A break below this trend channel would open the door to a move back towards the December lows under 1.3200, hit at the peak of no-deal Brexit fears.

Such a move would most likely be driven by USD strength rather than GBP weakness and would likely coincide with USD gains against most of its other G10 peers (and a move in the Dollar Index towards 92.00). That is of course a big if, given much of the market remains very bearish towards the US dollar.

GBP/USD daily chart