- GBP/USD has reversed its gains as the dollar benefits from upbeat US data.

- The last economic release for the week may outweigh Britain’s vaccine success.

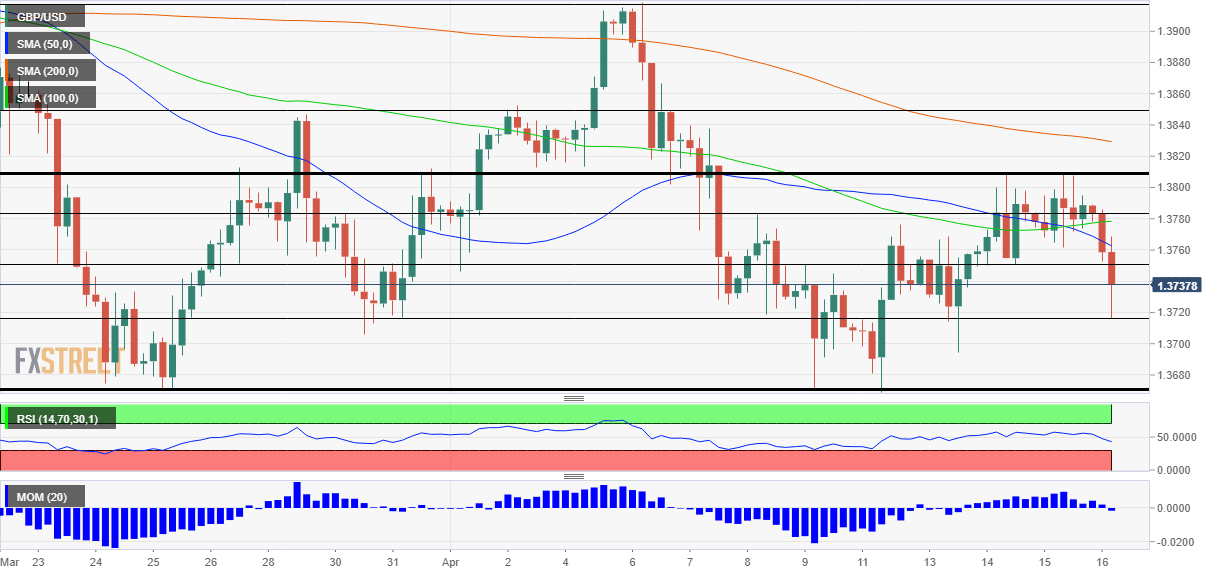

- Friday’s four-hour chart is showing momentum has turned to the downside, triple bottom in danger.

Hangover – Sterling has been falling from the highs and reconnecting with the reality of a robust US economy, just as many Brits felt after returning to the pub following 97 dry days earlier this week. Will the downfall continue?

The greenback gained ground following a series of robust economic statistics. Retail Sales leaped by 9.8% in March as Americans armed with stimulus checks stormed the stores. The more recent jobless claims figures for the week ending April 9 were also encouraging, printing a drop to 576,000 – the lowest post-pandemic level. Only industrial output figures disappointed.

While Treasury yields surprisingly dropped – probably due to fresh demand from Asia – the dollar shrugged off this move and responded to the data. On Friday, the last consumer figure for the week is eyed – the University of Michigan’s preliminary Consumer Sentiment Index for April.

See US Michigan Consumer Sentiment April Preview: Happiness is on the way

Similar to this week’s other releases, the economic calendar is pointing to a positive read, and real estimates could even be higher. If shoppers show optimism in this survey, it would give the greenback another boost. It has the final word.

What about the sterling part of the equation? The UK continues benefiting from its gradual reopening, with Scotland joining England in announcing the removal of some restrictions. However, that is mostly priced into the pound. Moreover, America’s immunization effort is also moving at full speed, defying concerns of an imminent slowdown. Nearly 1% of the population receives a jab every day and all Americans will be offered vaccines from Monday.

All in all, dollar strength outweighs other forces – and for good reasons.

GBP/USD Technical Analysis

The four-hour chart is showing that cable is off its highs, but remains in range. However, momentum has turned to the downside and the currency pair is back below the 50 and 100 Simple Moving Averages. Bears are gaining ground.

Support awaits at the daily low of 1.3718, followed by the critical triple-bottom of 1.3670. Losing that line would open the door to a rapid fall toward 1.36.

Some resistance is at 1.3750, a support line from earlier in the week, then followed by 1.3780 and 1.3810.

The pause that refreshes: Are currency markets hesitant to run with US data?