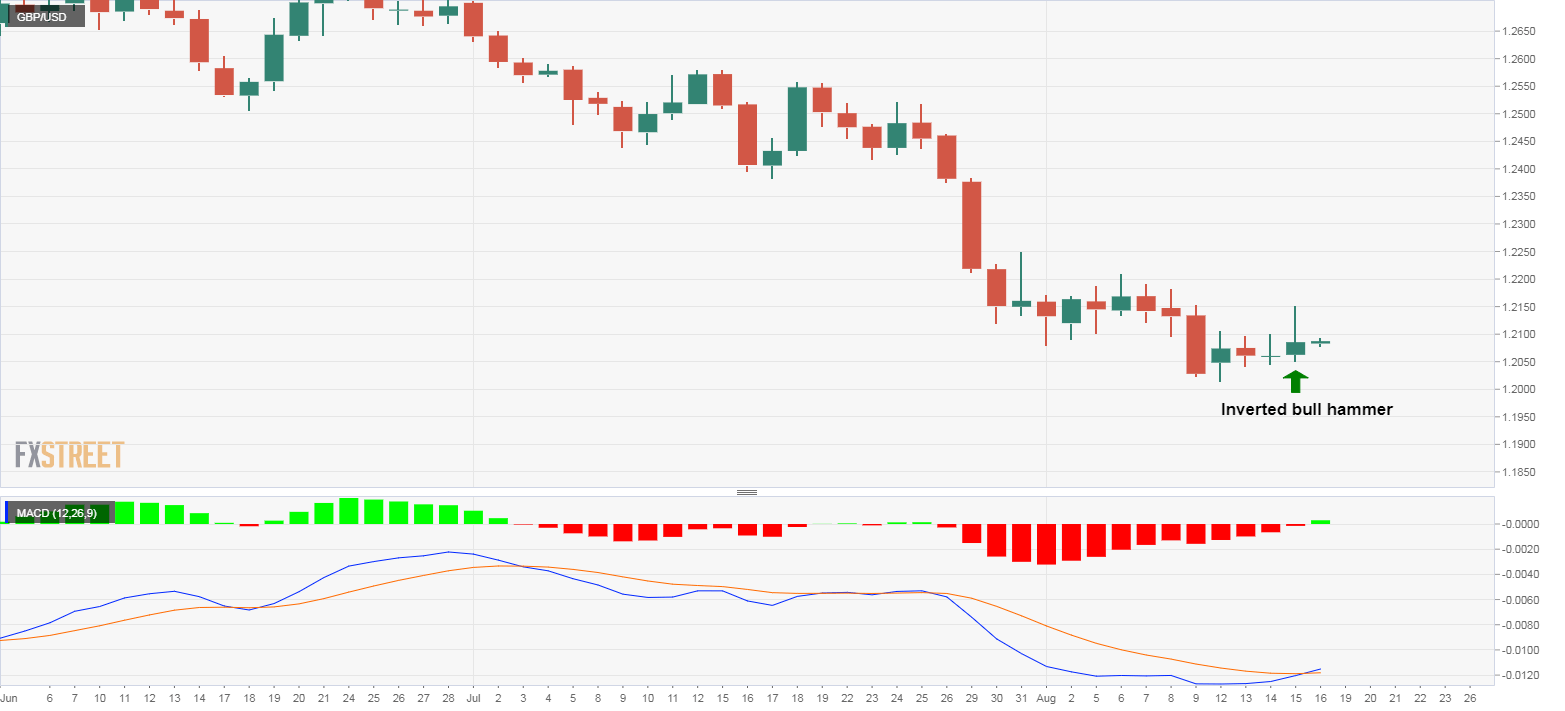

- GBP/USD created an inverted bullish hammer on Thursday.

- A close above 1.2150 would validate the inverted hammer and confirm a bullish reversal.

GBP/USD is currently trading at 1.2088, having created an inverted hammer candlestick pattern on Thursday.

An inverted hammer shows the bulls are beginning to test the resolve of the bears to keep the pair low and is considered an early sign of bullish reversal, especially if it appears following a notable sell-off, which seems to be the case here.

The inverted hammer is preceded by a sell-off from 1.2784 (June 25 high) to 1.2014 (Aug. 12 low).

A bearish-to-bullish trend change, however, would be confirmed only if the pair closes today above the inverted hammer candle’s high of 1.2150.

A bullish close looks likely as the moving average convergence divergence histogram has crossed above zero.

A bullish close, if confirmed, would open the doors to the former support-turned-resistance of 1.2382 (July 17 low).

The bullish case would weaken if the pair drops below the hammer candle’s low of 1.2050.

Daily chart

Trend: Bullish above 1.2150

Pivot points