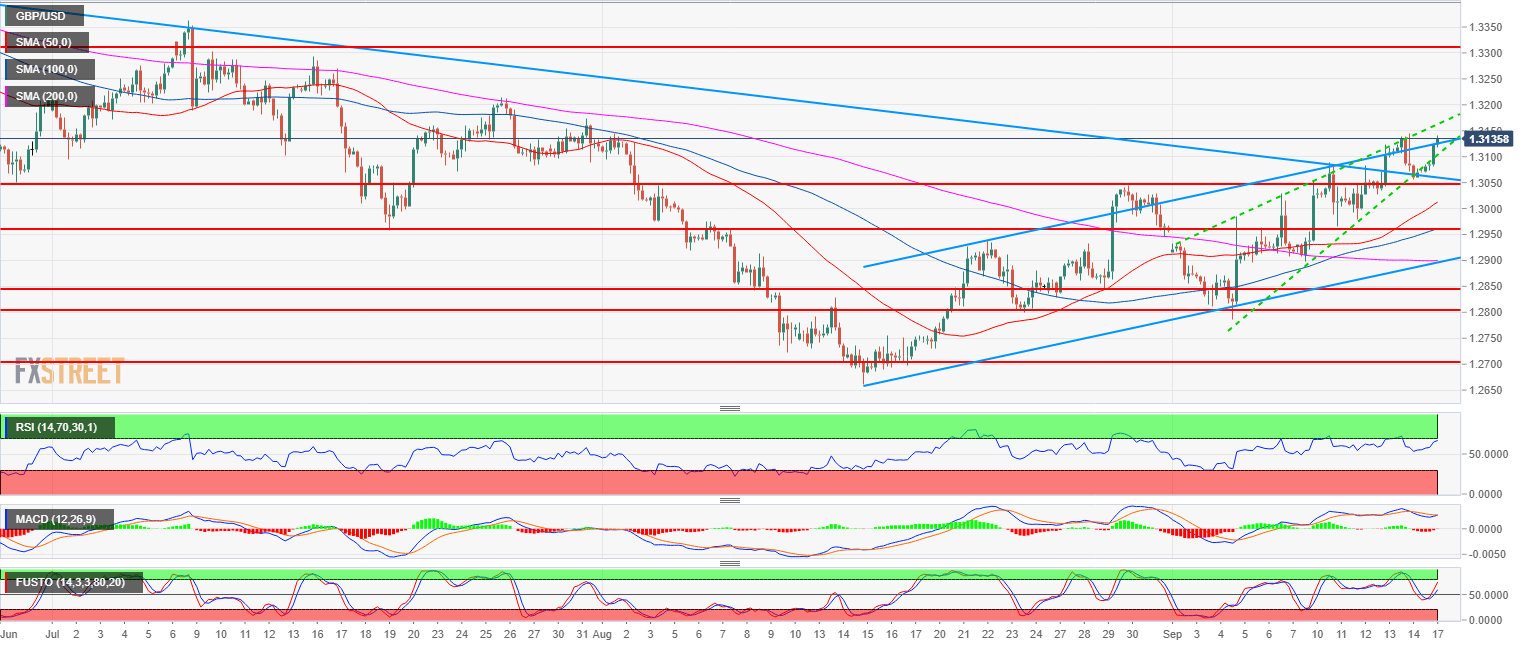

- GBP/USD main bear trend is on hold for the sixth consecutive week as bulls are working at creating a bullish reversal.

- GBP/USD is challenging the highs made last week as the market found support just above the 1.3050 support and the bull trendline (green line of the rising wedge). GBP/USD is trading well-above its 50, 100 and 200-period simple moving average on the 4-hour chart while the RSI, MACD and Stochastics are constructive to the upside; all suggesting that bulls should give no respite in the near future.

- If 1.3144 (last week high) is broken to the upside the next targets become 1.3200 figure (key support/resistance) and then 1.3300 figure is the scaling point.

Spot rate: 1.3144

Relative change: 0.56%

High: 1.3150

Low: 1.3069

Main trend: Bearish

Short-term trend: Bullish above 1.2800

Resistance 1: 1.3144 last week high

Resistance 2: 1.3200 figure (key support/resistance)

Resistance 3: 1.3300 figure

Resistance 4: 1.3472 June 7 high

Support 1: 1.3082-1.3100 supply/demand level and figure

Support 2: 1.3050 August 30 swing high, key level

Support 3: 1.3000 figure

Support 4: 1.2957 July 19 swing low

Support 5: 1.2937 August 22 swing high

Support 6: 1.2900 figure

Support 7: 1.2868 August 22 low

Support 8: 1.2845, August 29 low

Support 9: 1.2800 August 24 swing low