- The cable is down nearly 200 pips from daily highs as the DUP (Democratic Unionist Party) rejects the Brexit deal.

- GBP/USD is now battling with the 1.2800 handle.

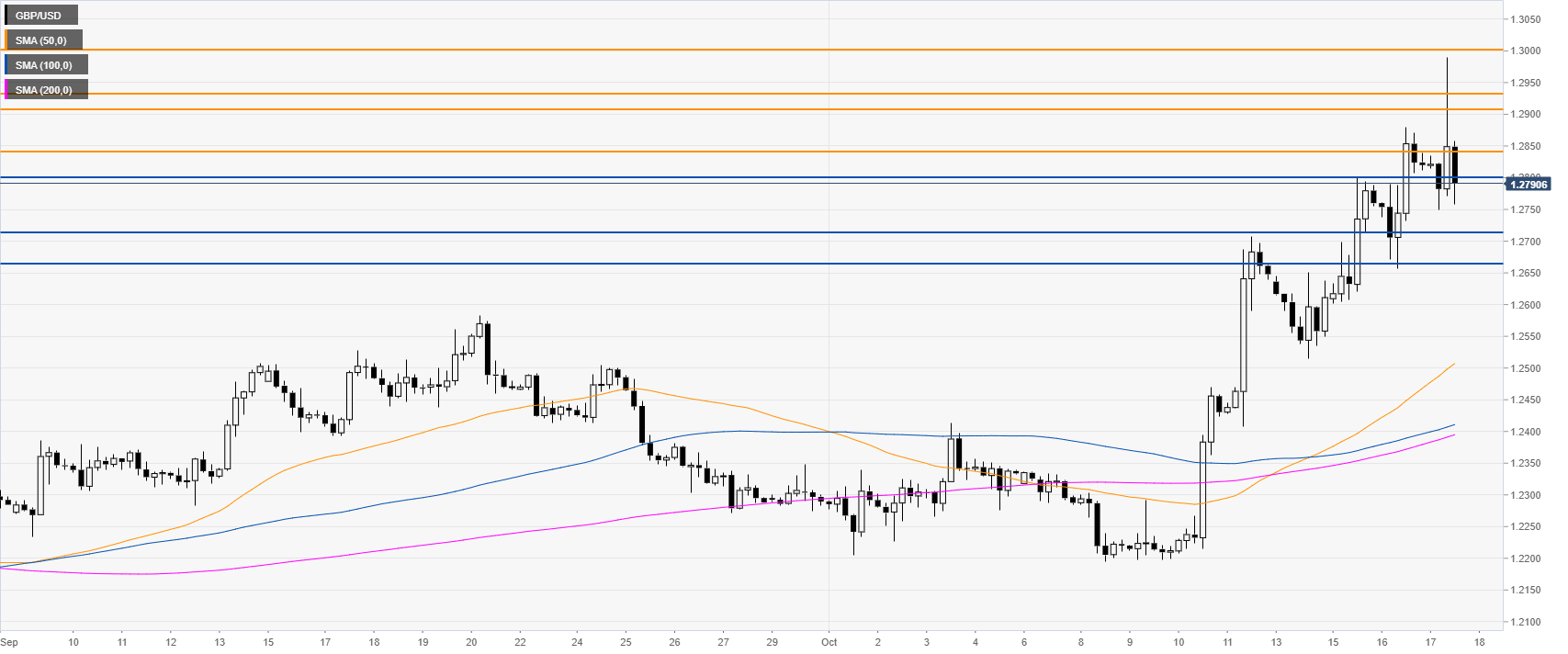

GBP/USD daily chart

The Sterling, on the daily time frame, is trading above its main daily simple moving averages (DSMAs). GBP/USD is retreating sharply from daily highs as the DUP (Democratic Unionist Party) rejects the Brexit deal.

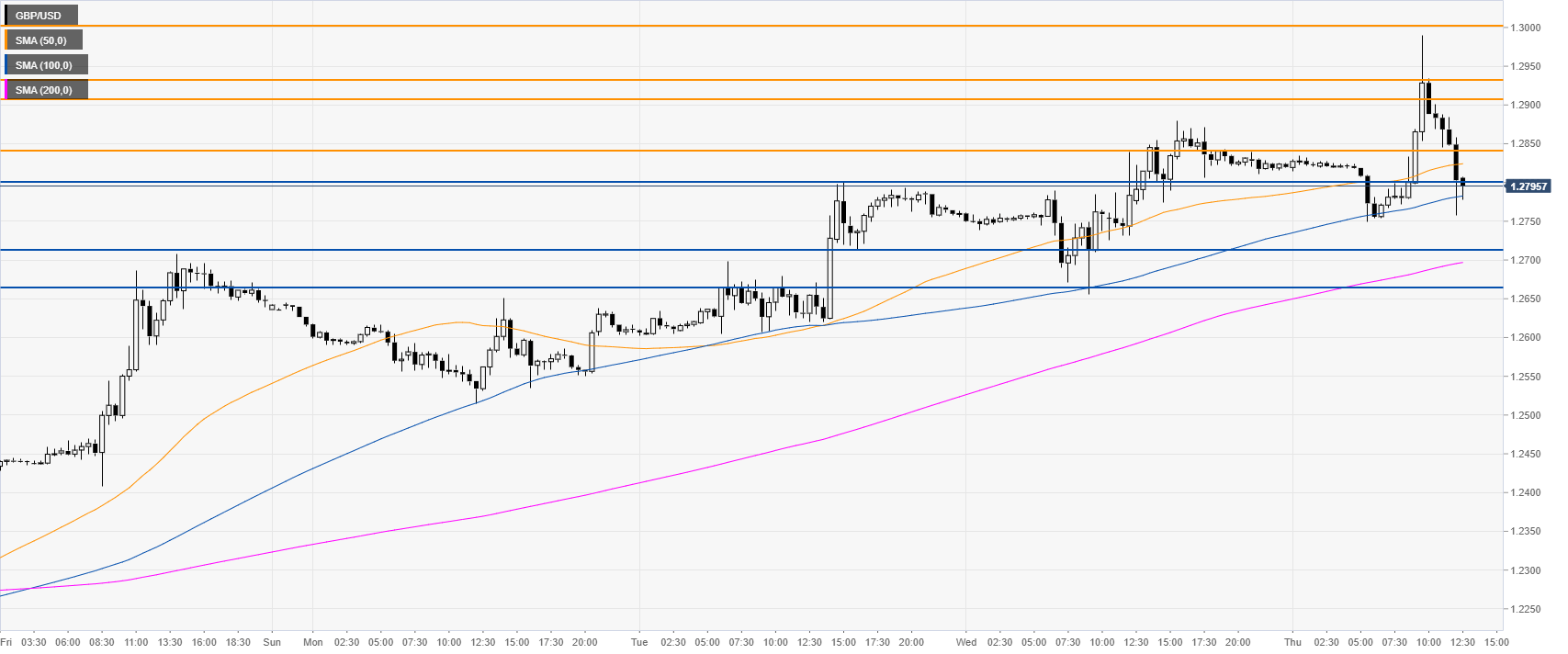

GBP/USD four-hour chart

GBP/USD rejected the 1.3000 handle and is now back near the 1.2800 handle. The Sterling is trading above the main SMAs, suggesting bullish momentum. Buyers will need to reclaim the 1.2840 level to target again the 1.3000 handle.

GBP/USD 30-minute chart

GBP/USD is trading above the 100 and 200 SMAs, suggesting bullish momentum in the near term. Support is at the 1.2710 and 1.2666 price levels, according to the Technical Confluences Indicator.

Additional key levels