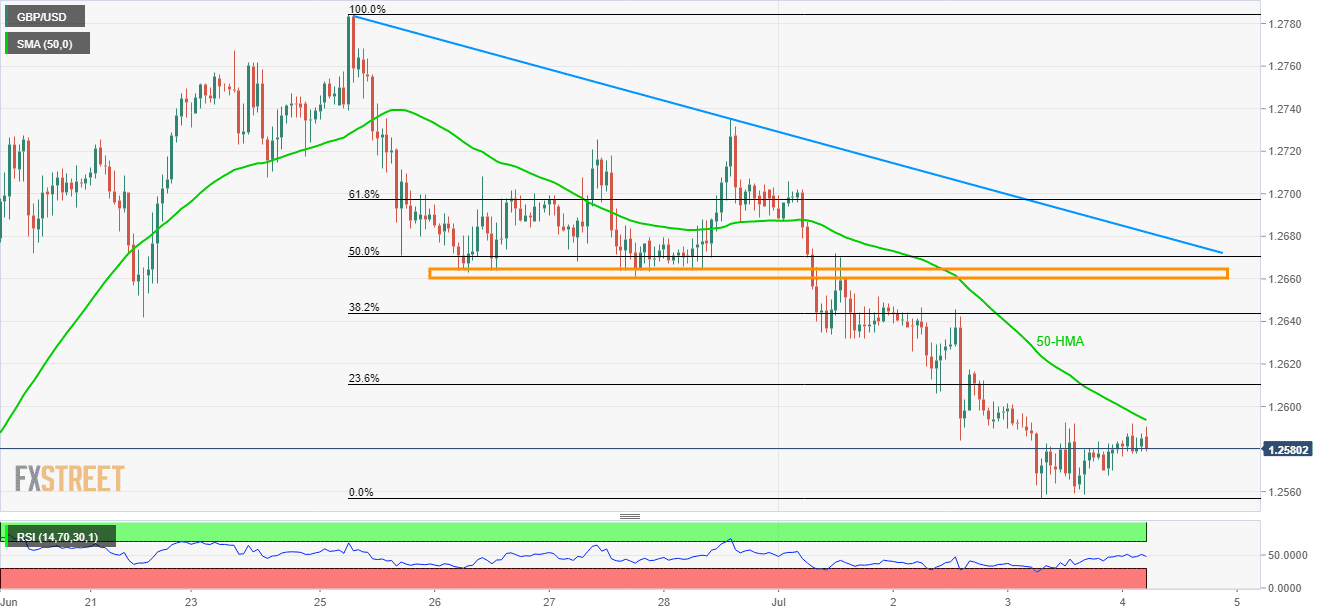

- 50-HMA, 1.2630 and then a horizontal region can hold the GBP/USD pair’s latest recovery confined.

- A downside break of 1.2560 can recall June month low.

Despite gradually recovering from 1.2557, the GBP/USD pair’s upside has many upside barriers, starting with the 50-HMA, as the quote takes the rounds to 1.2580 ahead of the UK open on Thursday.

On the break of 50-hour moving average (50-HMA) level of 1.2594, the pair may rise further towards confronting 1.2630 while 1.2660/65 horizontal area and a 9-day long descending trend-line at 1.2682 can question further advances.

If at all prices rally beyond 1.2682, June 28 high of 1.2735 and 1.2785 comprising June 25 high can please the bulls.

Alternatively, 1.2557 can act as immediate support for the pair ahead of looking at the June month low near 1.2506.

Should 14-bar relative strength index (RSI) remains in the normal region by then, sellers can aim for 1.2480 and 1.2430 numbers to the south.

GBP/USD hourly chart

Trend: Bearish