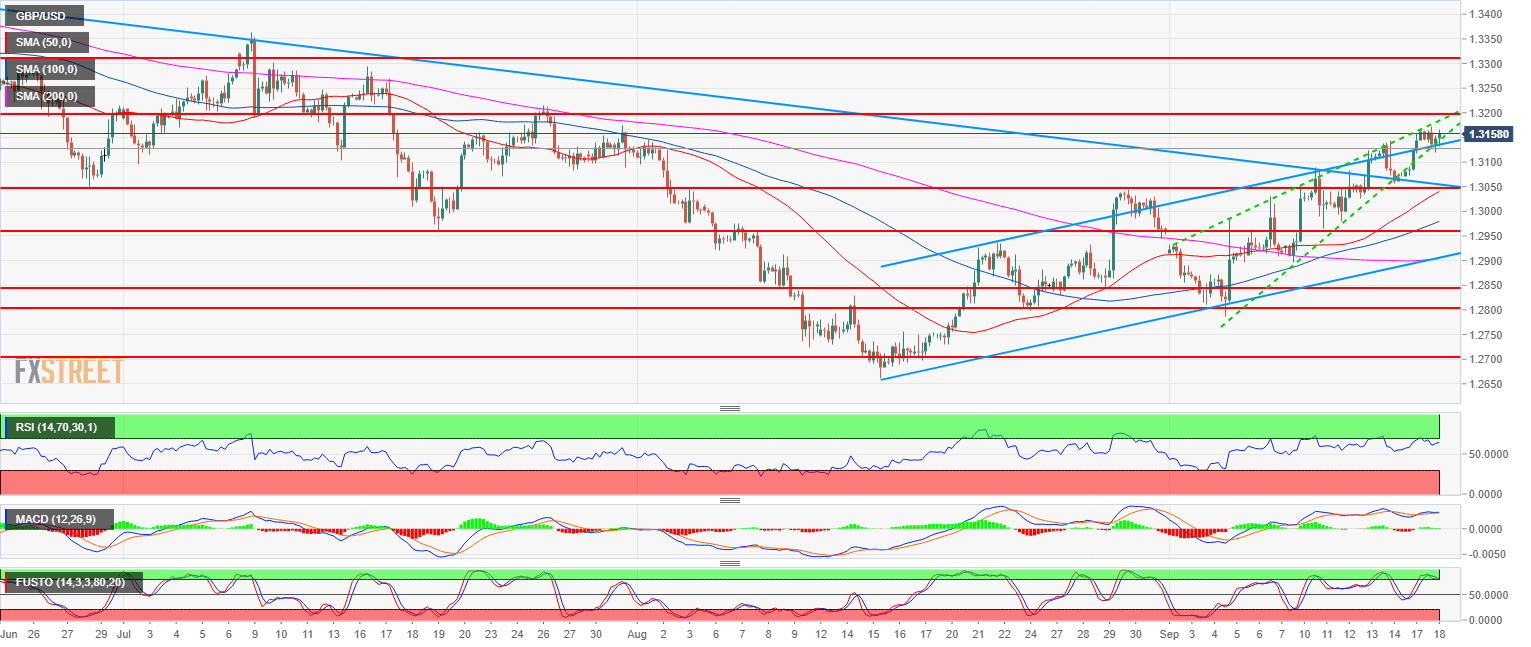

- GBP/USD main bear trend is on hold for the sixth consecutive week.

- GBP/USD is trading above its 50, 100 and 200-period simple moving averages which are starting to rise and widen suggesting building bullish momentum. Although GBP/USD is trading in a rising wedge (green lines) and the Stochastics indicator is in overbought conditions the current bull trend is strong as bears have been rather absent from the market for the last six weeks.

- The next objective for bulls is to overcome the 1.3200 figure in order to reach the 1.3300 level.

Spot rate: 1.3160

Relative change: 0.00%

High: 1.3171

Low: 1.3118

Main trend: Bearish

Short-term trend: Bullish above 1.2800

Resistance 2: 1.3200 figure (key support/resistance)

Resistance 3: 1.3300 figure

Resistance 4: 1.3472 June 7 high

Support 1: 1.3144 last week high

Support 2: 1.3082-1.3100 supply/demand level and figure

Support 3: 1.3050 August 30 swing high, key level

Support 4: 1.3000 figure