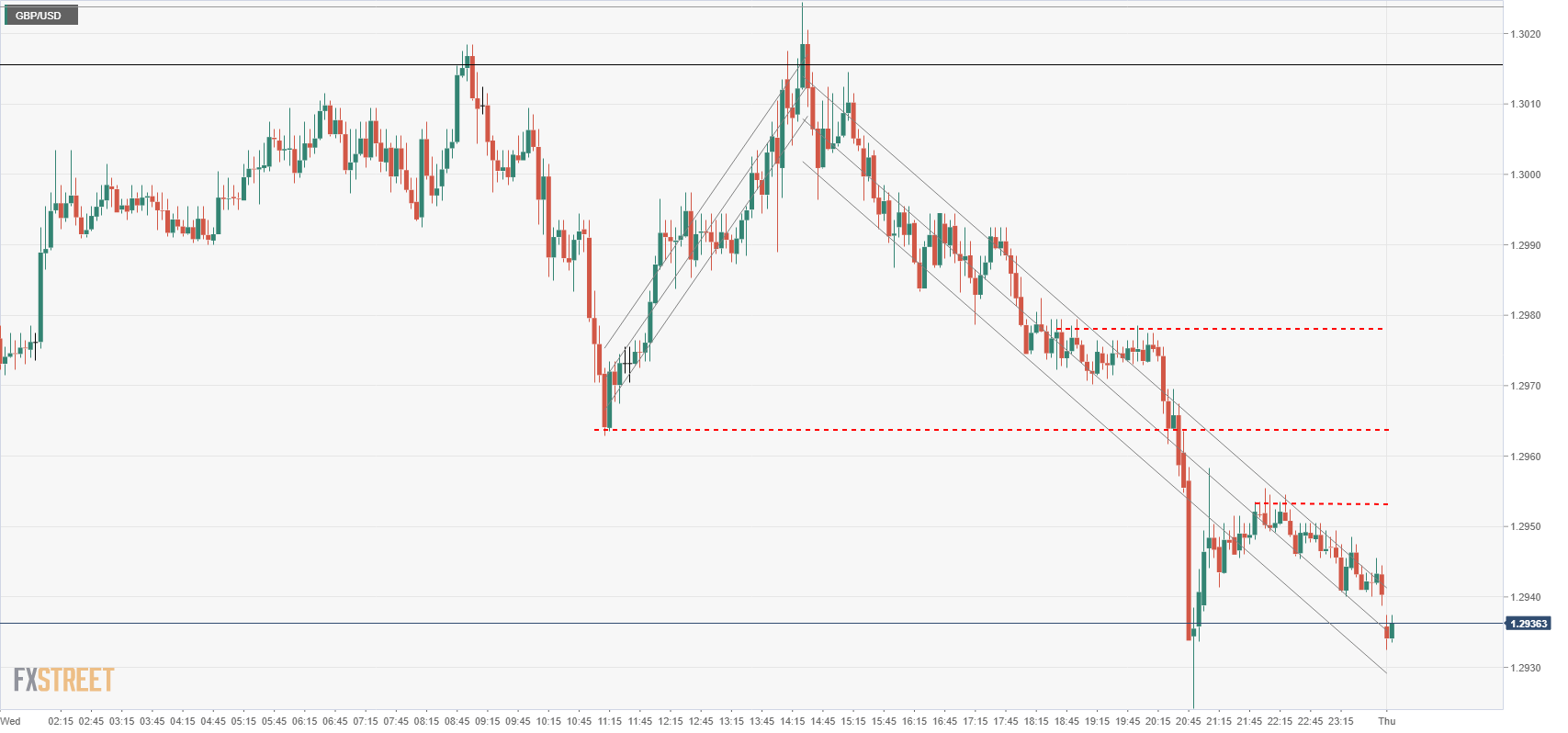

- The GBP/USD will need to scramble if buyers are going to pick the pair up from the week’s bottoms thanks to a swift decline yesterday, and recovery bounces quickly coming under short-side pressure from USD bidders.

- The Sterling is testing back into recent swing lows as mid-August’s bullish recovery looks set to wane with plenty of room below the 200-day SMA, and the GBP/USD is nearing the 50% retracement area of 2018’s technical bottom.

- The Pound is -4.26% off of 2018’s opening prices, and has shed nearly -10.0% off of its chart from March’s peak at 1.4376, and the year’s fourth quarter looks set to face similar declines, with the pair slipping -0.82% as the Sterling rounds the corner into a second week of straight losses, with the pace of declines giving hints of possibly accelerating, assuming the US Dollar index continues its current course.

| Spot rate | 1.2936 |

| Week change | -0.78% |

| Previous week high | 1.3217 |

| Previous week low | 1.3000 |

| Support 1 | 1.2922 (current day low) |

| Support 2 | 1.2900 (major technical barrier) |

| Support 3 | 1.2828 (August 27th swing low) |

| Resistance 1 | 1.2953 (Late Wednesday consolidation) |

| Resistance 2 | 1.2964 (Previous day swing low) |

| Resistance 3 | 1.2978 (Intraday consolidation zone) |