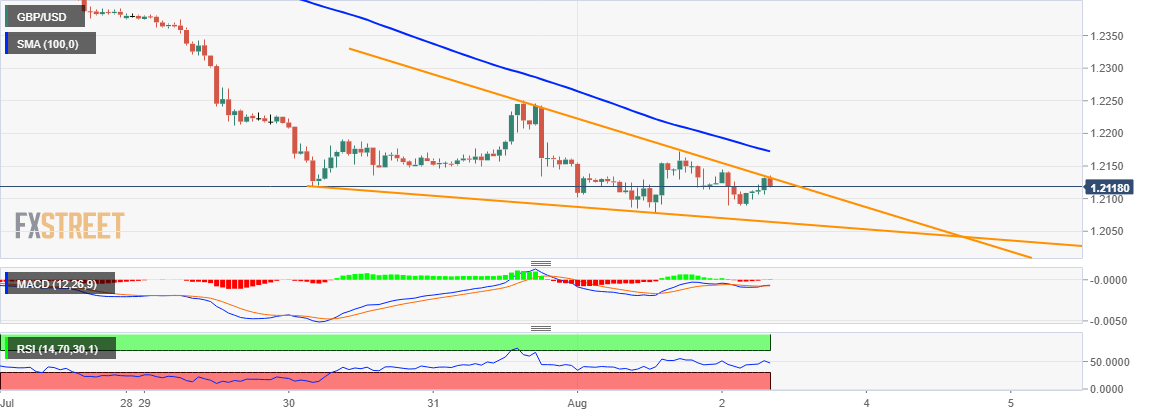

- The GBP/USD pair has been showing some resilience below the 1.2100 handle, albeit any attempted recovery remained capped near a short-term ascending trend-line resistance.

- This along with another descending trend-line, acting as a support, seemed to constitute towards the formation of a rising wedge – bullish reversal pattern on the 1-hourly chart.

With technical indicators on hourly charts still struggling to gain positive traction or recover from the oversold territory on the daily chart, it will be prudent to wait for a strong follow-through buying before confirming that the pair might have already bottomed out.

Sustained break through the pattern resistance, leading to a subsequent move beyond 100-hour SMA, currently near 1.2170-75 region, will reinforce the constructive outlook and trigger some aggressive short-covering move towards reclaiming the 1.2200 handle.

The momentum could further get extended, albeit seems more likely to fizzle out at higher levels and might still be seen as a selling opportunity near the 1.2245-50 region amid increasing odds that the UK will eventually crash out of the EU on October 31.

On the flip side, weakness back below the 1.2100 handle might continue to find some support near the lower end of the falling wedge – currently near the 1.2065 region, which if broken will set the stage for further weakness towards the key 1.20 psychological mark.

GBP/USD 1-hourly chart