- GBP/USD may be enjoying temporary relief on the relaxation of lockdowns in a risk-on environment.

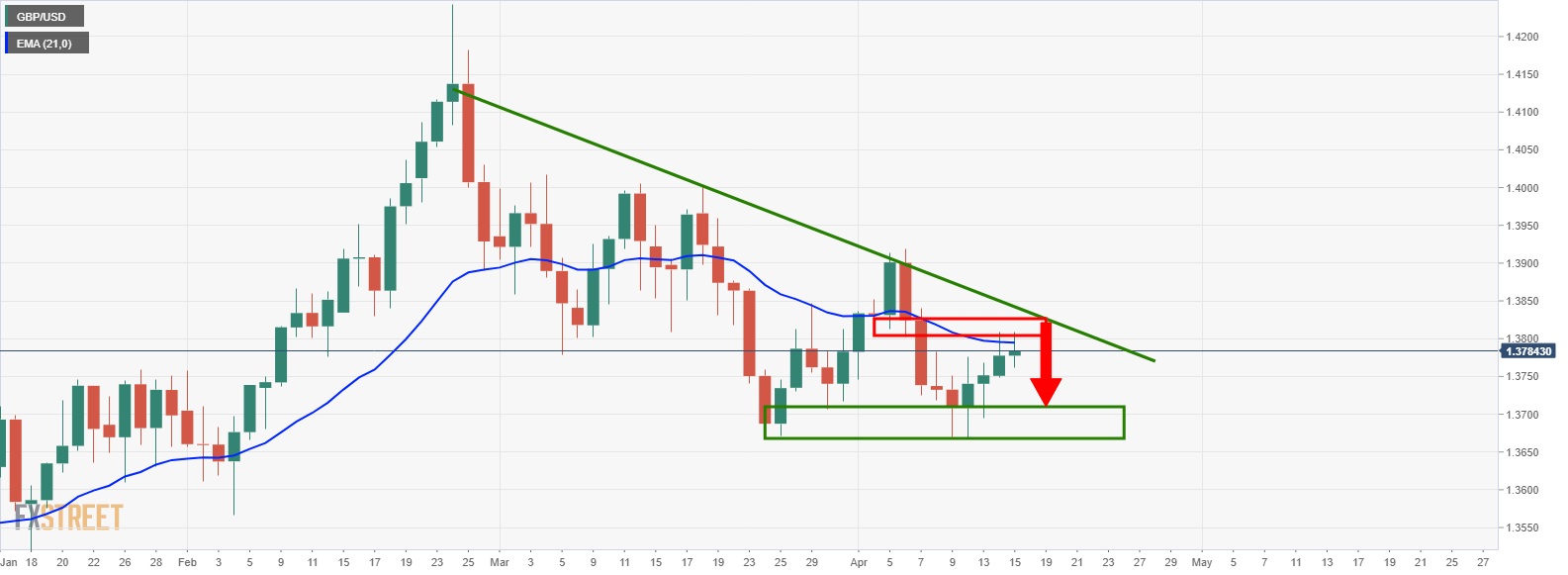

- Technically, the outlook for sterling is bearish over the medium term.

GBP/USD is trading around flat on Thursday, printing 1.3783 at the time of writing having travelled between a low of 1.3761 and a high of 1.3808.

It’s been a mixed day as traders weigh up the outlook for the US dollar, UK and US economies.

The dollar index edged higher on Thursday following a poor performance on Wednesday that led to a follow-through in London where the DXY hit a low of 91.4930 before recovering.

Investors have had to balance bullish data showing US Retail Sales rebounding sharply in March against a continued drop in US Treasury yields.

Treasury yields have plummeted from below the one-year highs reached last month to reach fresh lows on Thursday.

The 10-year yield has printed a low of 1.5390% and is down a whopping 6.23% at the time of writing, the lowest level in more than a month.

Yields have fallen as the US Federal Reserve reiterates its commitment to holding rates near zero for years to come, and on some concerns that a recent uptick in inflation will be temporary.

The drop in yields has outstripped any positive takeaways for the dollar that it might have otherwise found from an extremely strong Retail Sales report for March.

Retail Sales jumped by 9.8% last month, according to the Commerce Department, sailing past the 5.9% consensus in a robust turnaround from February’s 2.7% decline.

The Labor Department was also the harbinger of good news which has also offered strong evidence that the US economy is shifting into high gear.

The number of American workers filing new applications for unemployment benefits plunged last week to 576,000, 124,000 fewer than analysts expected.

Also, the high level of jobless claims dipped below the 665,000 level seen at the nadir of the Great Recession for the first time since the COVID-19 crisis struck.

Subsequently, there is a strong risk-on environment into the last few sessions of the week which may well continue to undermine the greenback.

Domestically, the pound can enjoy the UK’s lockdown-easing steps which are expected to accelerate the UK’s economic recovery.

England has re-opened all retail stores, hairdressers, gyms and pub gardens this week and online job adverts have returned to pre-pandemic levels.

However, on the flip side, the vaccine rollout, or aka, the vaccine trade, was already priced into the pound.

Other countries will eventually catch up on the UK’s pace of vaccination, which could see profit-taking weighing on the pound as investors balance the risks of the UK’s twin deficits.

GBP/USD technical analysis

As per the prior analysis, GBP/USD Price Analysis: Bears eye failure at critical daily/weekly resistance, the price remains in a bearish technical environment and the daily head and shoulders is a compelling prospect still: