- GBP/USD has been recovering amid Britain’s vaccine rollout, hopes the disease is peaking, and Bailey’s bullish comments.

- The greenback has room for a comeback that may turn cable back down.

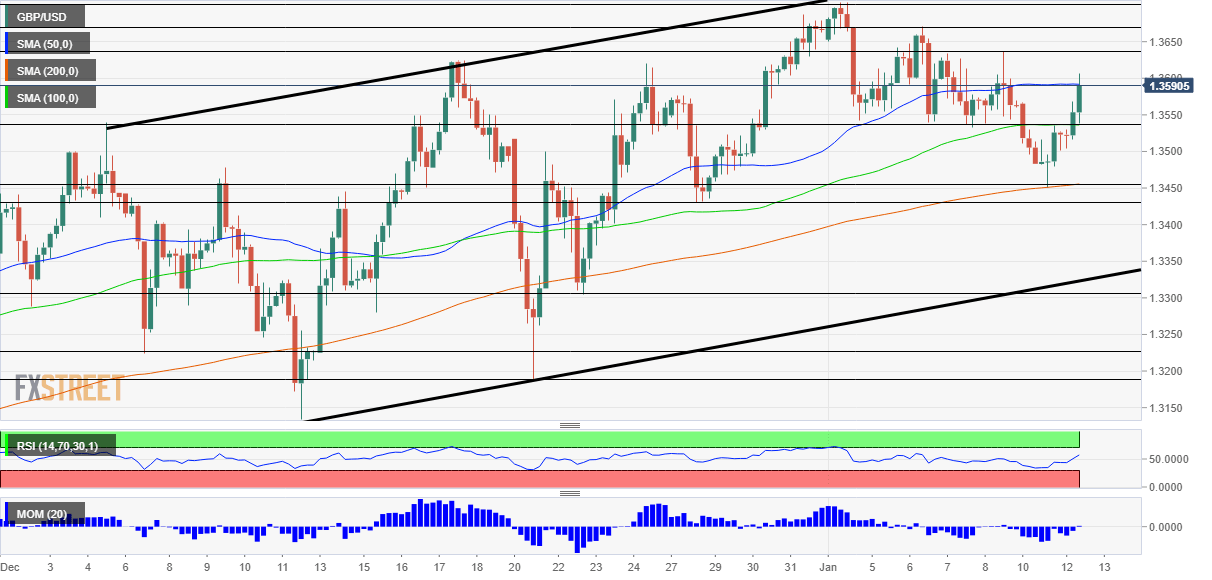

- Tuesday’s four-hour chart is painting a mixed picture.

Is Britain turning a corner against coronavirus? The initial signs are anecdotal and tentative, but a dose of hope is helping sterling outperform not only the retreating dollar but also the euro. Can this trend continue? While UK optimism may prevail, the dollar may stage a comeback.

Here are the factors boosting the pound:

1) Vaccine ramp-up

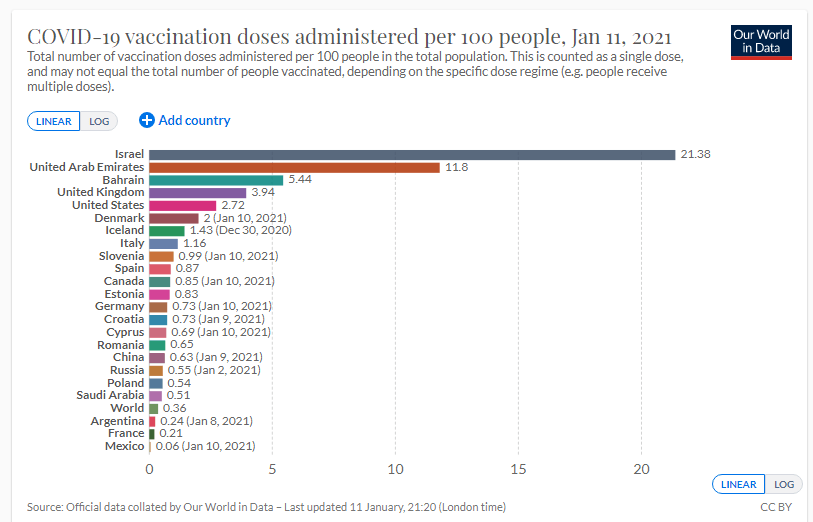

Prime Minister Boris Johnson’s pledge to boost the vaccination campaign is bearing some fruit. Over two million people have received at least one coronavirus immunization dose – more than all of continental Europe combined.

Around 96% of Brits are within ten miles of a vaccination center, a figure reflecting the national effort. Britain is using three jabs, from Pfizer/BioNTech, Moderna, and the AstraZeneca/University of Oxford. A relatively rapid exit from the crisis is boosting the pound.

Source: OurWorldInData

2) London outbreak peaking?

The winter wave of coronavirus has been hurting the capital hard – especially due to the new variant. According to borough-level data, the number of cases in London may have peaked. These are only tentative signs, but it seems that the strict lockdown and pleas from doctors to respect the rules are having some impact.

Additional data – such as that coming in the afternoon for the whole country – is needed to add to optimism.

3) Bailey cooling on negative rates

Andrew Bailey, Governor of the Bank of England, has said that negative interest rates are “controversial” and have “a lot of issues.” At the same time, he has added that it is too soon to reach any conclusion about stimulus – before the lockdown measures and Brexit have an effect.

The BOE is awaiting evidence in the next few weeks and may consider providing more support. However, it seems that the bank would favor expanding its bond-buying scheme – which has boosted sterling in the past year – rather than sub-zero borrowing costs, which weigh on the pound.

The reaction has been another push higher in the pound.

Dollar lurks in the shadows

The greenback benefited from the risk-off mood in markets on Monday – attracting safe-haven flows. However, stocks have been edging higher on Tuesday, allowing the dollar to pare its gains. Can this continue?

US Treasury yields – which have been the main driver of dollar strength – have not retreated from their highs. Federal Reserve officials have been dismissing the need to taper the scheme, but merely talking about tightening rather than discussing more accommodation is a positive sign for the greenback.

Lael Brainard, a Governor at the Federal Reserve, speaks later in the day. She may join the chorus in expressing optimism about the post-pandemic economy and hint about moving out of stimulus. That has the potential to end the current GBP/USD rally.

The political and historical political drama in Washington is currently dismissed by markets, which focus on President-elect Joe Biden’s stimulus plans rather than President Donald Trump’s incitement of the mob and its implications. Biden’s speech about the economy is more significant than impeachment proceedings in Congress.

GBP/USD Technical Analysis

Bulls are taking over – pound/dollar surpassed the 50 Simple Moving Average and momentum has turned positive. The Relative Strength Index is still below 70, far from overbought conditions.

The next resistance line awaits at 1.3640, a swing high from last week. It is followed by 1.3670, another temporary top, and finally by 1.3705, the multi-year peak.

Some support awaits at 1.3545, a former double-bottom, followed by 1.3450, the 20201 troughs. Further down, 1.3430 and 1.33 await GBP/USD.

GBP/USD Price Forecast 2021: Cable braces for calendar comeback amid three exits