- GBP/USD is trading at lower ground amid several global concerns.

- Hopes for a coronavirus cure are insufficient to boost sterling.

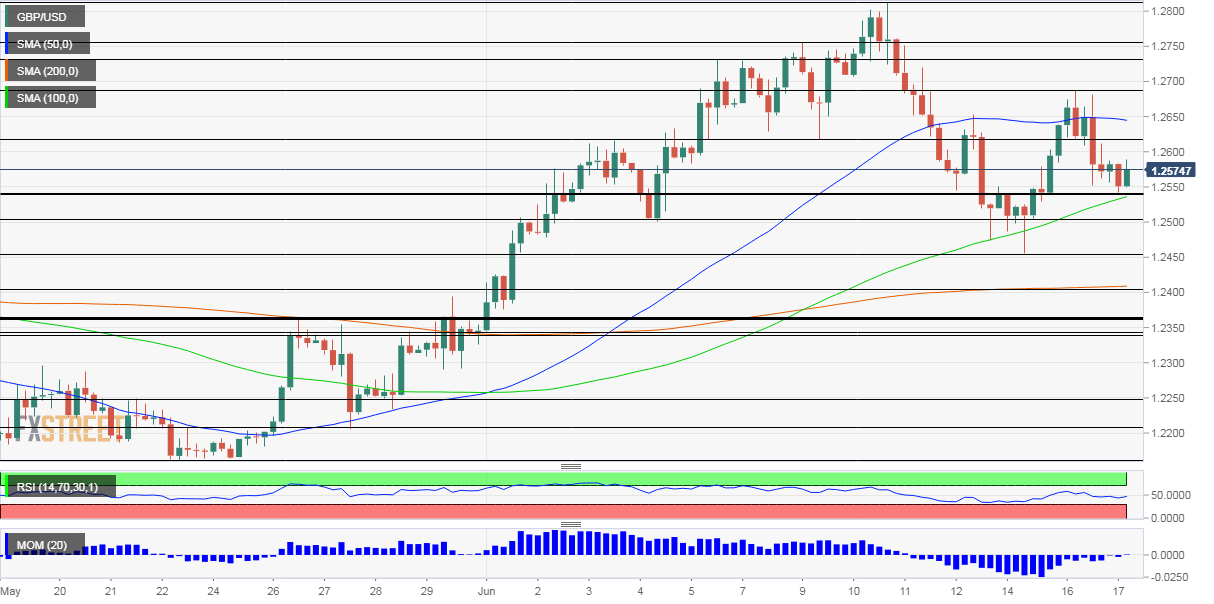

- Wednesday’s four-hour chart is painting a balanced picture.

“Dexamethasone helps us to turn the corner against the coronavirus” – the words of Matt Hancock, the UK’s Health Secretary, seem premature. The cheap steroid drug has shown to reduce mortality from COVID-19 by up to a third according to a broad randomized controlled study conducted by the University of Oxford. That is undoubtedly good news.

However, GBP/USD has other issues to grapple with.

First, the UK’s coronavirus curve is moving down – yet frustratingly slowly. The government is loosening the lockdown at a snail’s pace in comparison to its peers at the continent and demands a 14-day quarantine on incoming visitors- all but killing the tourism sector.

European colleagues are also at odds with Britain on Brexit. Despite Prime Minister Boris Johnson’s optimism about accelerating talks – or “putting the tiger in the tank” in his words – talks may drag on for longer. According to a report in Germany, negotiations will only heat up after the summer.

That would brink the UK closer to the brink of the transition period that expires at year-end – raising the risk of falling to World Trade Organization terms in 2021.

UK inflation extended its fall, hitting 0.5% yearly in May. While this statistic met expectations, it is another sign of coronavirus’ carnage to the economy, after jobless claims leaped more than predicted last month.

The Bank of England announced its decision on Thursday and will likely expand its bond-buying scheme – boosting the pound, depending on the size. However, Governor Andrew Bailey’s openness to negative rates may weigh on sentiment.

See Bank of England Preview: Bailey may boost pound by going big on bond-buying, beware negative rates

GBP/USD is also battling dollar strength, stemming from safe-haven flows. The increase in COVID-19 cases in the US Sn Belt and Beijing is causing concerns. China is also involved in a border clash with India in the remote Galwan valley up in the Himalayas. Efforts to de-escalate are underway and could weaken the safe-haven dollar.

Another geopolitical conflict involving nuclear weapons is in the Korean peninsula, where both Pyongyang and Seoul have heightened their rhetoric after the North’s bombing of a liaison office on the border. High tensions keep the dollar bid in this case.

Jerome Powell, Chairman of the Federal Reserve, testifies later in the day on Capitol Hill and will probably remain cautious. He seemed encouraged by robust retail sales figures – jumping 17.7% in May, double the expectations – but said a full recovery depends on dealing with the health issue.

Overall, there is more room to the downside for pound/dollar than to the upside.

GBP/USD Technical Analysis

The currency pair bounced off the 100 Simple Moving Average on the four-hour chart but failed to conquer the 50 SMA. Momentum and the Relative Strength Index are both balanced. All in all, the picture is mixed.

Support awaits at 1.540, the daily and where the 100 SMA hits the price. It is followed by 1.25, a support line from early June, and then by 1.2450, the weekly low. 1.24 and 1.2360 are next.

Resistance awaits at 1.615, a swing low from last week, followed by a weekly peak of 1.2680. Further up, 1.2735 and 1.2755 await GBP/USD.