- Cable moves higher after Retail Sales surprised to the upside.

- UK Retail Sales expanded more than expected in January.

- PM May suffered another defeat at the HOC on Thursday.

The Sterling recovered some shine following the release of today’s data in the UK docket, sending GBP/USD to levels above the 1.2800 handle.

GBP/USD bid after data, looks to Brexit talks

Unexpected auspicious results from the UK calendar are sustaining the up move in the pair to the 1.2800 area.

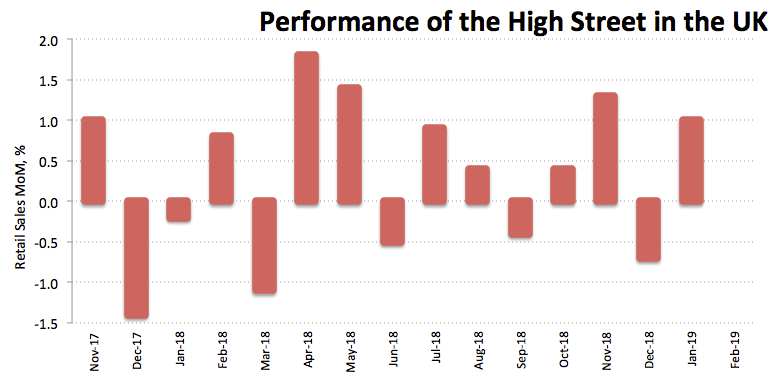

In fact, headline Retail Sales in the United Kingdom expanded at a monthly 1.0% during the first month of the year and 4.2% from a year earlier. Additionally, Core sales expanded 1.2% inter-month and 4.1% over the last twelve months.

That said, GBP is looking to recover some ground lost in the last couple of sessions in the wake of poor inflation figures and omnipresent uncertainty around the Brexit negotiations. Regarding the latter, markets remained muted following another largely anticipated defeat of PM Theresa May in the House of Commons on Thursday.

It is worth recalling that another vote is expected on some other option of May’s ‘Plan B’ later this month (probably on February 27).

What to look for around GBP

Another defeat of PM May yesterday passed largely unnoticed among investors. The British Pound is expected to remain under increasing pressure as the clock continues to tick and there is no progress on the horizon (or even any hint of it). So far, consensus among market participants points to a most likely extension of Article 50 in the next weeks or a deal on the 11th hour. However, the Irish backstop issue stays unsolved and a ‘hard’ scenario remains on the table. Adding to this picture, soft inflation figures as of late and prospects of extra deterioration in UK fundamentals should be enough to keep occasional rallies in GBP well capped.

GBP/USD levels to consider

As of writing, the pair is gaining 0.07% at 1.2810 facing the next hurdle at 1.2883 (10-day SMA) followed by 1.2958 (high Feb.12) and then 1.3000 (high Jan.17). On the downside, a breach of 1.2772 (low Feb.14) would pave the way for a visit to 1.2668 (low Jan.15) and finally 1.2476 (2018 low Dec.12).