- GBP/USD has been struggling as Brexit concerns accumulate.

- The UK jobs report and coronavirus headlines are in play.

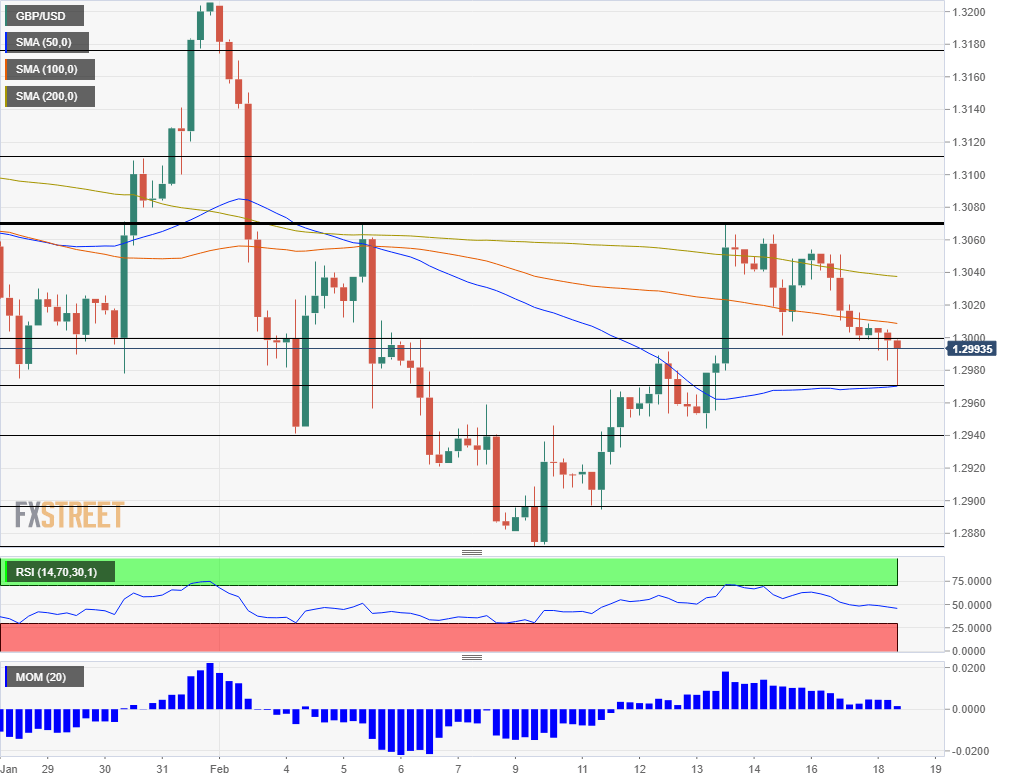

- Tuesday’s four-hour chart is pointing to worsening conditions.

Brexit headlines have begun biting – finally. Long days of acrimonious headlines from both sides of the English Channel have finally pushed the pound lower.

The straw that broke the camel’s back came from David Frost, the chief UK negotiator. He rejected the EU’s demand to play by its rules and said that Britain being able to make its own rules is “the point of the whole project.” His defiant words come ahead of official talks about future relations due to begin in around two weeks.

The UK has left the EU but retains most obligations and rights through year-end. Brussels and London are set to tussle through talks about future trade relations starting from 2021. Prime Minister Boris Johnson has repeatedly said he will not ask to extend the curent temporary arrangement.

UK data also fails to help the pound. Average Earnings growth slowed to 3.2% when excluding bonuses and 2.9% when including them – both figures fell below expectations. While the data is somewhat stale, it adds to pressure on the pound. The Unemployment Rate stands at 3.8%.

GBP/USD has also dropped below 1.30 due to US dollar strength related to the coronavirus outbreak. Apple – one of the world’s most valuable companies – has announced it will fail to meet its guidance due to production issues for its flagship iPhone and due to reduced sales in China. While the number of new infections and deaths has decelerated, the economic impact is becoming starker. The greenback benefits from elevated concerns.

GBP/USD Technical Analysis

Pound/dollar failed to recapture 1.3070 – a double-top – and that kicked off a slide which sent the currency pair below the 200 and 100 Simple Moving Averages on the four-hour chart. Cable holds onto the 50 SMA and but while upside momentum persists, it is waning.

Support awaits at 1.2970, which is the confluence of the daily low and the 50 SMA. Next, 1.2940 held GBP/USD up last week and also in early January. It is followed by 1.2890 and 1.2875.

Initial resistance is at the round level of 1.30, followed by 1.3070 mentioned earlier. The next lines to watch are 1.3110 and 1.3175.