- There was a rise in US inflation in August.

- UK inflation eased for the first time in almost a year.

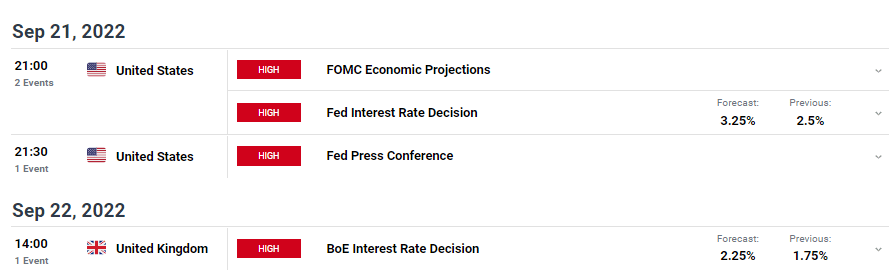

- Markets are awaiting rate hikes from the Fed and the BoE.

The GBP/USD weekly forecast is bearish as markets expect a more aggressive Fed, strengthening the dollar against most other currencies.

–Are you interested to learn more about Forex demo accounts? Check our detailed guide-

Ups and downs of GBP/USD

There were many significant news releases from the US and the UK last week, but investors paid more attention to inflation data from both countries. According to data from the Labor Department, overall consumer prices in the US increased by 0.1% from July to August, more than the decline experts had predicted, and increased by 8.3% from the same time last year.

Contrary to expectations, underlying inflation in the US has been broadening out.

On the other hand, inflation in the UK fell for the first time in about a year due to cheaper fuel prices. These reports are bound to affect next week’s rate decisions.

Next week’s key events for GBP/USD

Next week will be very volatile for GBP/USD. Following this week’s consumer price index report that came in hotter than anticipated, investors are looking forward to the Fed meeting next week. The central bank is anticipated to implement another big rate hike.

Investors in interest rate futures changed their bets on Friday, favoring the Bank of England raising interest rates by half a point next week. Earlier this month, there was a more than 80% likelihood that the bank would hike rates by 75 basis points.

GBP/USD weekly technical forecast: Bullish divergence favoring short-term pullback

Looking at the daily chart, we see the price trading below the 22-SMA and RSI below 50. Bears are in charge of the market and have paused at 1.1401, proving to be a solid support level. The RSI is showing a bullish divergence with the price, which could mean that bears are not as strong as they were previously.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

At this point, more sellers need to come in for the downtrend to continue. However, buyers can take over at this level and push the price higher if they don’t. A bullish move would, however, encounter a lot of resistance from the 22-SMA and the 1.1722 key resistance level. It is, therefore, possible that the bullish move would only be a pullback, and the downtrend will continue after.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.