- The GBP/USD weekly forecast is bearish as the US dollar soared across the board.

- The UK CPI increased 3.2% over last year, compared to the Bank of England’s target range of 1-3%.

- Two BoE members voted in August to reduce bond purchases, and the number could increase.

- Chairman Powell is expected to be cautious given the recent weakening data and its dovish tendencies.

The GBP/USD weekly forecast is bearish as the US dollar soared across the board. As a result, the pair saw a net negative change of 95 pips during the week.

-Are you looking for the best CFD broker? Check our detailed guide-

Last week’s latest data was a cause for concern and confusion among investors. In this week’s events, central banks are likely to take center stage since the timing of the Fed cut and the possibility of a Bank of England rate hike is crucial for the GBP/USD pair.

US inflation is falling, as demonstrated by the August Core Consumer Price Index (Core CPI), which fell 4% year-over-year, while import prices dropped 0.3% instantly. The drop in inflation confirms the view of Federal Reserve Chairman Jerome Powell that the rise in prices is temporary and may delay the bank’s decision to cut interest rates.

A “consumer strike,” however, may cause inflation to fall as a result of previously increased spending. As long as that demand disappears forever, the US and global economy could be put under pressure. The US dollar has thrived because of that mindset.

The UK CPI increased 3.2% over last year, compared to the Bank of England’s target range of 1-3%. Sterling was giddy with excitement.

There is, however, a downside to price hikes in the UK – potential blackouts during winter. Even though September was a mild month and winter was beginning, natural gas prices rose in Europe and the UK. Consumers can end up with empty pockets even without experiencing a catastrophic failure. The recovery is at risk.

The government of British Prime Minister Boris Johnson changed, but Sunak stayed as Treasury Secretary. Before the cold season, the Prime Minister has also increased vaccination rates due to high cases in the UK. However, hospitals are not facing significant pressure. The number of serious cases is lower in the UK than in the US because vaccination rates are higher.

What’s next for GBP/USD weekly forecast?

Two BoE members voted in August to reduce bond purchases, and the number could increase. However, Andrew Bailey, Governor of the Bank of England, told MPs that the Monetary Policy Committee split 4:4 on whether the conditions for raising rates had been met.

As the minutes reveal current trends in the MPC, the pound could be shaken, especially if Bailey appears to have been cornered by the growing chorus of hawks.

While the inflation rate is on the rise and unemployment is falling – 4.6% in July – it is unlikely the Bank of England will change policy by then. However, we will closely watch what comes out of Super Thursday in November for any hint of a decision.

This meeting will not address the September cone – also referred to as the “Septaper” – but the announcement will most likely be valid.

Other questions also remain. Is it November or December? What will the decline be like? When will the Fed raise interest rates? Chairman Powell is expected to be cautious given the recent weakening data and its dovish tendencies. Moreover, price increases seem temporary when inflation is low, which supports his point of view.

Additionally, the bank releases forecasts for growth, inflation, employment, and interest rates. After shocking the markets with two rate hikes in 2023, it is unlikely to reverse course this time around. So those words by Powell will likely have a bigger impact.

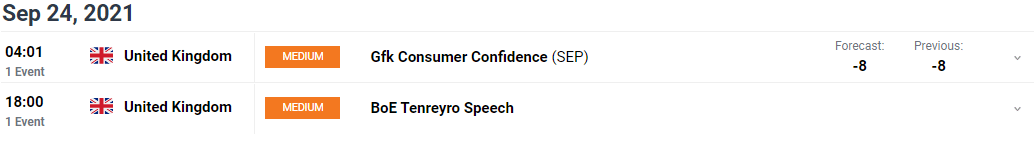

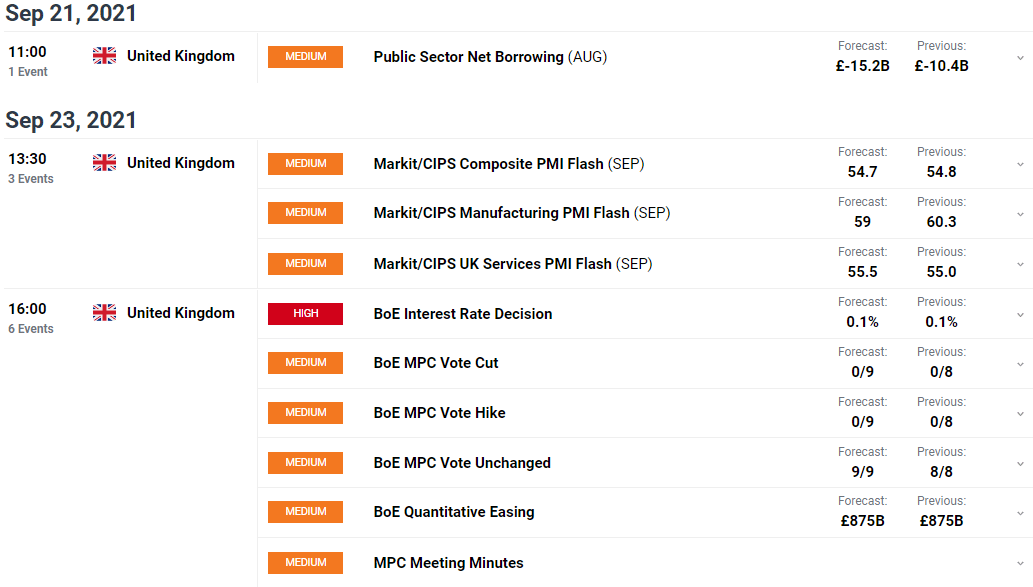

Key data events from the UK next week

There are several medium impact events from the UK next week. However, BoE interest rate decision is as important as the market participants are eager to find clues about the rate hike schedule.

-Are you looking for forex robots? Check our detailed guide-

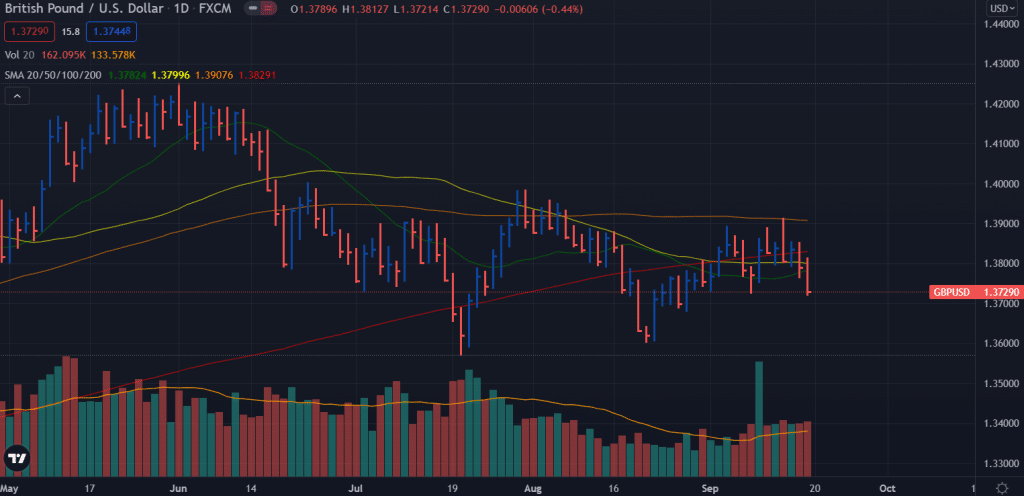

GBP/USD weekly technical forecast: Pullback capped by 1.3770

The GBP/USD price broke the key support of 1.3800 level and closed below the key 20, 50, 100, and 200 DMAs. The pair closed the week at 1.3729 at the horizontal support line, where it may find some rejection, and the pullback can extend to 1.3770 area ahead of 1.3800. On the downside, the pair may see another support at 1.3700 ahead of multi-week lows at 1.3660. The bearish volume is intensifying.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.