- As several worries faded, the GBP/USD has continued its rebound.

- Markets will be influenced by US inflation statistics, UK employment figures, energy costs, and Brexit.

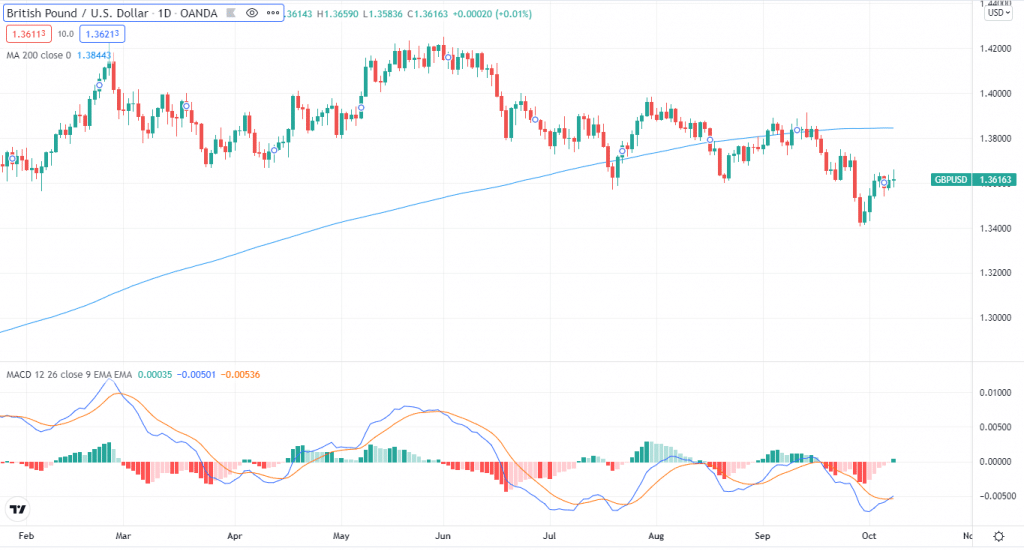

- Bears are in control of the daily chart as of mid-October.

The GBP/USD weekly forecast is mildly bearish as fundamental drivers keep the currency under pressure. Last week, the cable did recover because of the easing of the UK’s energy crises and the lower jobs data announcement on Friday. However, this is a temporary pullback for the greenback, and the bears will try to take the bull’s place.

-Are you looking for forex robots? Check our detailed guide-

GBP/USD weekly fundamental forecast

The debt limit problem has been sent down the road, and energy costs have eased, allowing GBP/USD to rebound.

Lower jobs data

In September, the US economy added only 194,000 jobs, considerably less than projected. However, significant upward revisions and mild increases in leisure and hospitality, owing to the proliferation of the Delta variant, improve the statistics.

The dollar fell, although this is expected to be short-lived as the Federal Reserve implements its taper strategy.

Energy crises slowed down

As public demand declined and British army drivers assisted in distributing fuel, UK petrol outlets saw less pressure than before.

Brexit brawl

The United Kingdom and France fought over fishing rights, a minor industry, while London and Brussels tussled over the Northern Ireland agreement. The pound is still dealing with the fallout from Britain’s EU withdrawal.

-Are you looking for the best CFD broker? Check our detailed guide-

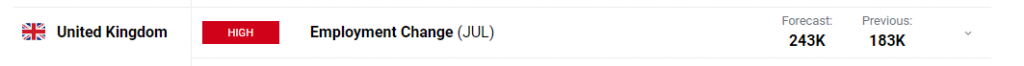

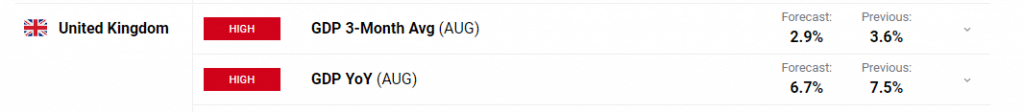

Key Data Releases from the UK during Oct 11-15

The employment report is the most important event on the UK economic calendar. Economists predict that the unemployment rate will remain unchanged in August, at 4.6 percent.

Expectation the Bank of England to hike rates sooner rather than later may strengthen the pound if another optimistic labor data is released.

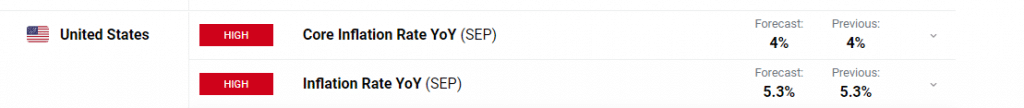

Key Data Releases in the US during Oct 11-15

Concerns about inflation remain at the forefront of the market’s mind, and investors will watch the latest Consumer Price Index numbers for September.

GBP/USD weekly technical forecast: key levels in action

On the daily chart, the GBP/USD pair has been trading under a downtrend resistance line and has negative momentum.

The cable is below the 200-day moving average, and the MACD shows a downward trajectory.

The pair found support at 1.3540 in early September, which acted as a buffer. It is followed by 1.34, the latest trough for 2021.

The immediate resistance level is 1.3560, which was the October high, followed by 1.3750, the cable’s late-September high. The levels at 1.3840 and 1.3910 are the next potential targets.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.