The weakness of the euro, which is most evident against the dollar with near 12 year lows, is also having an impact on the cross-channel currency pair.

At the time of writing, EUR/GBP is trading at 0.7134, extending its falls. If we look at the cross the other way around, GBP/EUR is trading above the very round number of 1.40.

Brits and Europe

GBP/EUR is a very relevant cross for an estimated 750,000 to 1 million Brits living in Spain. It is estimated that around 2 million UK citizens live in the “continent” as mainland Europe is often named by the English.

Some of them are pensioners looking to enjoy retirement under the sun, and others just work, study or pass long periods of time in the old continent. In Spain, certain villages look like any town in the UK, apart from the sun of course.

Everything is cheaper in Spain: property prices, public transport, food and beer are all sold at lower prices than in the UK. British owned businesses operate solely in Spain and cater to the needs of Brits who prefer a taste of home rather than the local specialties, which are remarkable to my personal taste.

This 1.40 milestone in GBP/EUR, if it persists, could increase tourism and also property buying, especially in the sunnier and cheaper areas of the euro-zone.

Spain, southern France, most of Italy and even Greece, once things stabilize, could certainly enjoy heightened activity by Her Majesty’s subjects.

More GBP/EUR upside going forward

The British pound has also suffered against the greenback, but the proportions are totally different. From a fundamental perspective, the UK is expected to raise rates later this year, like the Fed. And even if it happens long months after the expected US rate hike, it is still years before a move in the euro-zone.

The ECB just began its ambitious bond buying scheme, which is set to run through September 2016. In addition, interest rates in the currency union will probably stay lower for even longer.

Foreign exchange is never a one way street, and eventually a weaker euro will result in stronger local economies in Spain and other countries, eventually lifting the euro. Nevertheless, there seems to be quite a lot of room to run up for pound/euro. Is 1.50 the next target?

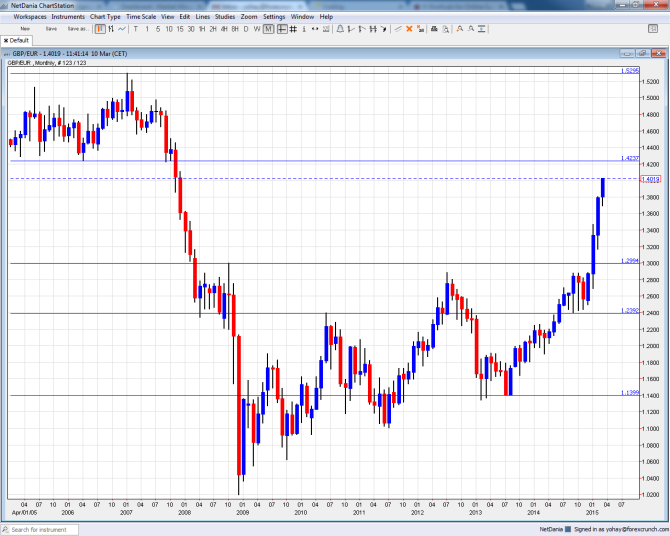

Here is a monthly chart of GBP/EUR. Note that the cross is trading at the highest since December 2007, before Northern Rock crashed.

Notable lines on the topside are 1.4237, which was support before the late 2007 fall. The peak of 1.53 in early 2007 is another noteworthy level.

On the downside, significant support awaits at the very round number of 1.30.