Technical Bias: Bullish

Key Takeaways

“¢ British pound looks set for more gains against the Japanese yen.

“¢ Mixed Japan’s trade balance data failed to impress the Japanese yen buyers.

“¢ GBPJPY support seen at 172.90 and resistance ahead at 173.50.

The British pound continued its rise against most of its counterparts, including the Japanese yen despite softer than expected inflation figures as buyers were seen unfazed by the outcome.

Technical Analysis

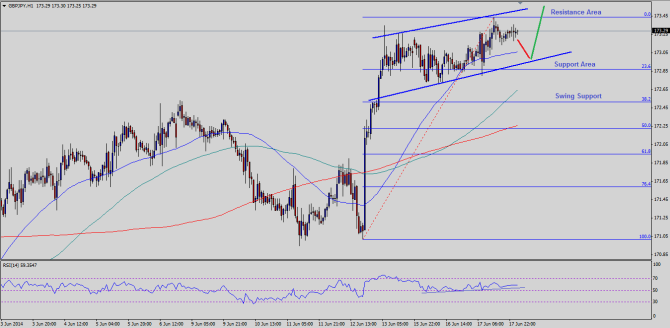

There is an important flag pattern forming on the hourly timeframe for the GBPJPY pair. This pattern is formed after a sharp rise from the 171.00 support level. There is a trend line forming on the hourly RSI as well with support above the 50 level, which can also be considered as a bullish sign supporting the flag pattern. Currently, the flag resistance trend line is around the 173.50 level and support at 172.90. However, the 50 hourly simple moving average might continue to hold the downside in the pair ahead of the trend line support area. If the pair jumps from the current levels, then it might test the mentioned resistance zone. If buyers succeed in breaking the pattern, then a move towards the 174.20 resistance area is possible in the short term.

On the downside, if buyers fail to hold the 50 hourly SMA, then it would be interesting to see whether they manage to defend the support trend line or not. Any further downside acceleration might take the pair towards the 100 hourly SMA, followed by an important confluence support area of 200 hourly SMA and 50% Fibonacci retracement level of the last surge from the 171.02 low.

Japan’s Imports and Exports Data

Earlier during the Asian session, the Japan’s imports, exports and trade balance data were released. The outcome was more on the disappointing side, as imports fell by 3.6% and exports by 2.7%.

Overall, as long as the pair stays within the flag pattern the chance of a break higher increase in the near term.