- GBP/JPY drops heavily after YouGov’s latest UK election poll based on the MRP model.

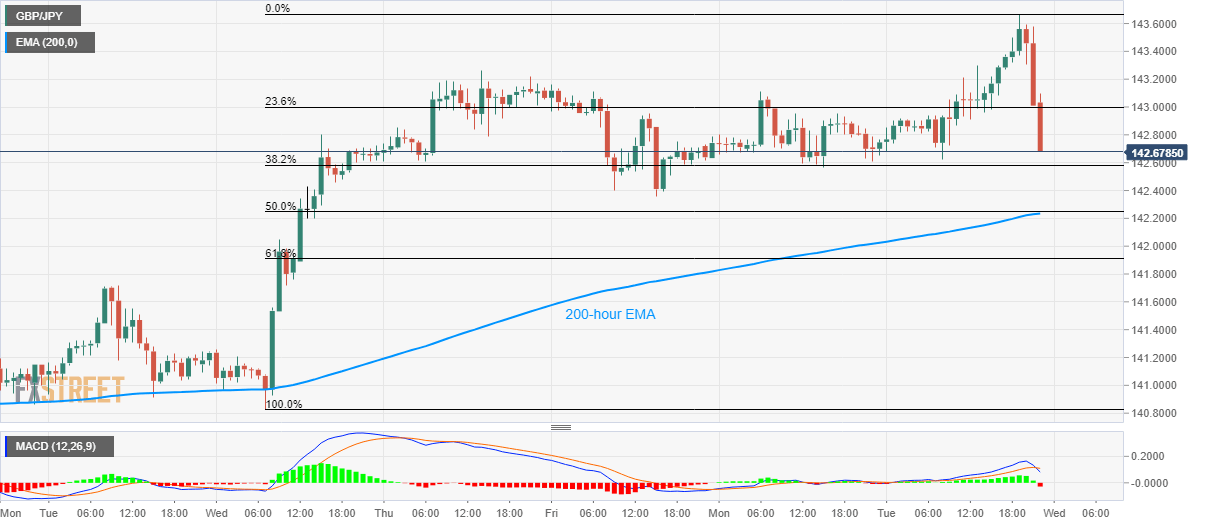

- The confluence of 50% Fibonacci retracement and 200-hour EMA in the spotlight for now.

- Highs marked in March/April offer key upside barriers.

GBP/JPY drops below 142.70 during the early Asian session on Wednesday. The pair plummeted after the YouGov polls concerning the United Kingdom’s (UK) election, on December 12, signaled receding lead of the ruling Conservative party.

Read: Breaking: Cable trades heavy on hung/tighter YouGov polls

With this, the 12-bar Moving Average Convergence and Divergence (MACD) indicator flashes a bearish sign. The same could lead sellers to 142.25/20 support confluence including 200-bar Exponential Moving Average and 50% Fibonacci retracement of December 04 to 10 upside.

Should there be additional weakness below 142.20, high marked on December 03 around 141.70 and the monthly low near 140.80 will become the Bear’s favorites.

Alternatively, buyers will stay away unless the pair successfully crosses 143.72/80 area including lows marked during March and April months.

GBP/JPY hourly chart

Trend: Pullback expected