The FED raised rates (no surprises here) but also upgraded the dot-plot to reflect three rate increases in 2017 in a move that surprised many. Janet Yellen downplayed the change in the dot-plot with the words “just” and “modest”. Nevertheless, the US dollar is on a roll.

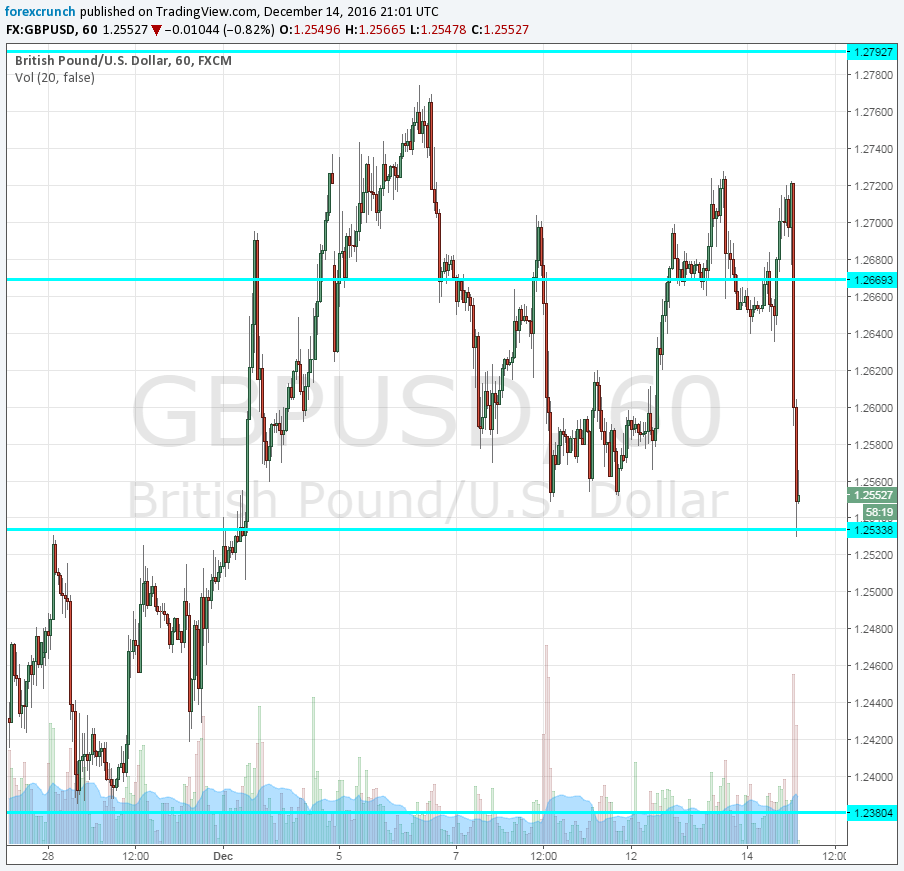

For the British pound, this meant a significant fall. Cable traded above 1.27 before the big event but crashed quite quickly. The low for the day is 1.2530, a line which was a swing high earlier this month. GBP/USD presents impressive technical behavior.

Further support awaits at 1.2380, followed by 1.23. Will it fall to these levels? A lot depends on the rate decision in the UK. So far this week, data in Britain was upbeat. Both inflation and the jobs report came out better than expected. Before the BOE decision, we will get the word about UK retail sales.

All in all, hopes for a soft Brexit and a healthy economy supported the pound. The halt at the support line seems convincing unless demand for the US dollar goes hyperbolic.

More: GBP: Sterling Is Cheap But Not Cheap Enough: Where To Target? – Deutsche Bank

Here is the GBP/USD chart: