The British pound was seen trading lower earlier today against the US dollar after climbing as high as 1.7167. The market was not seen willing to take the GBPUSD pair higher before a major risk event – the BOE interest rate decision. Moments ago, the UK trade balance data was published by the National Statistics.

The report mentioned that there was a deficit of £9.2 billion on goods, which was partly offset by an estimated surplus of £6.8 billion on services. This was more than the market expectations of £8.75 billion. This further added to the bearish pressure on the GBPUSD pair.

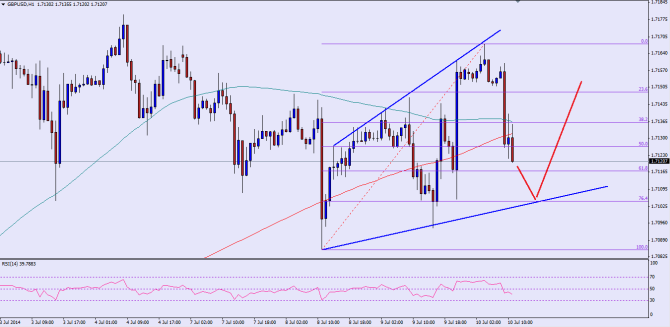

Technically, there is a triangle forming on the one-hour chart for the GBPUSD pair. The pair has tested the triangle resistance trend line a number of times, but failed to overtake the same. As a result, it came crashing down, and broke the 100 and 200 hourly simple moving averages. Moreover, the pair is now trading below the 50% fib retracement level of the last move higher from the 1.7085 low to 1.7167 high. It is very likely that the pair might fall towards the 61.8% fib retracement level. If sellers take control, then the triangle support trend line might be tested where buyers are likely to appear. It would be very difficult for sellers to push the pair below the triangle and open the doors for a new low in the short term.

Alternatively, if the pair bounces from the current or a bit lower levels, then the broken moving averages could act as a resistance for the pair.

So, keep an eye on the triangle support area, and if the pair stabilizes around the same, then the chance of a bounce back might increase moving ahead.

Posted By Simon Ji of IKOFX