The BOE laid down its massive hand and walloped the pound. Is there room for more falls? Here are opinions from Citi and BNP Paribas:

GBP/USD En-Route To Break Below 1.30 After BoE Clears High Bar – BNPP

The Bank of England Monetary Policy Committee (BoE MPC) voted 9-0 to cut the base rate from 0.50% to 0.25% and voted 6-3 to increase the asset purchase target by GBP 60bn to 435bn over the next six months. It also announced purchases of GBP 10bn of non-financial investment grade corporate bonds and said the majority of the MPC saw rates near zero by the year end.

The BoE, therefore, delivered on market expectations for rate cuts, over-delivered on quantitative easing, both regarding size, and composition, and sent a more aggressive than expected signal on future rate cuts.

GBPUSD has weakened in line with our view and we still see scope for further downside in the pair.

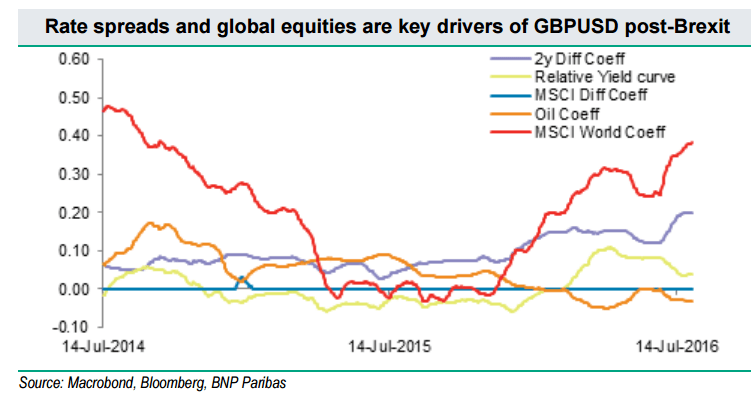

Our BNP Paribas STEERâ„¢ model signals 2y swap rates are the key driver of GBPUSD and, while UK rates are unlikely to fall much further, we see considerable scope for US rates to rise and push down GBPUSD. We still target the pair below 1.30 by the end of Q3.

BoE Gives Green Light For Lower GBP; We Stay Short – Citi

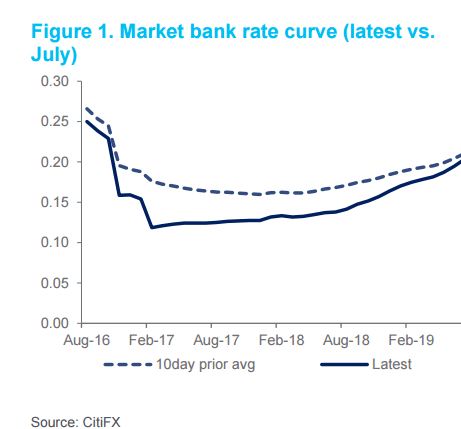

The MPC decided a 25bp cut, 60bn of new gilt purchases (over six months), 10bn of corporate bonds (over 18 months) and a term funding scheme. The BoE communicated a policy strategy fairly consistent with our expectations, buffering the increase in spare capacity and allowing for a sustained inflation overshoot. This much suggest they won’t lean against FX depreciation

The BoE exceeded consensus and with forward-guidance signaled more easing to come.

Combined, we think the measures are sufficient to keep existing GBPUSD shorts in the trade (ours included). This week’s decision is consistent with medium-term GBP weakness.

Citi maintains two short GBP/USD positions targeting 1.28 and 1.25.