UK Prime Minister Theresa May signed the letter triggering Article 50 last night. Today the letter will be officially delivered to the European Union.As far as we know so far, the tone has been formal and even conciliatory. More details will be released later on.

But the response will not necessarily be that positive. According to other reports, the European Union is focusing on the terms of the divorce and not on future trade. This narrow approach is a cause for concern. It is a tough stance.

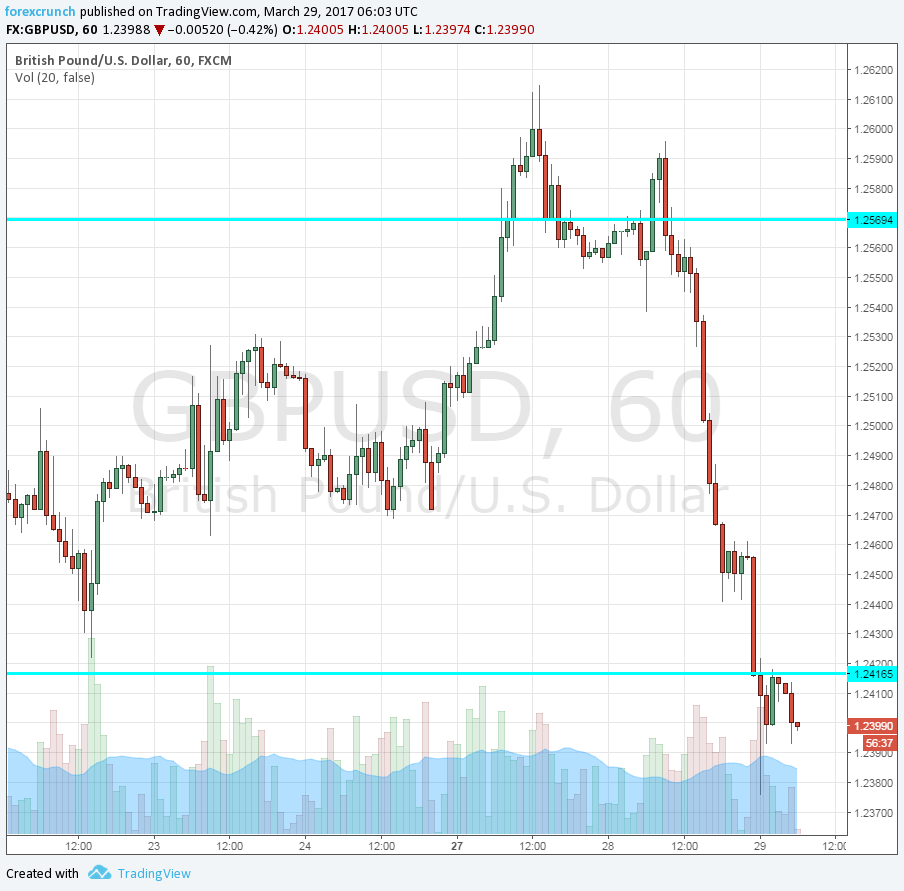

So, we are currently seeing the “just short” scenario, a net negative for the pound. Will we see further falls?

Full preview: GBP/USD: Trading Article 50 – 3 scenarios

Here is a quote from the report:

European Council President Donald Tusk’s guidelines for Brexit chief Michel Barnier will probably limit the scope of the upcoming talks to the terms of the divorce and not include a future trade relationship with the U.K, three people familiar with the matter said.

Donald Tusk is set to send his colleagues guidelines about Brexit within 48 hours. We could then see if this tough stance is real and how tough it really is. The guidelines will probably be approved on April 29th, between the two rounds of France’s presidential elections. Negotiations could wait for June.

GBP/USD reacted and it was not a short squeeze. The pound is tumbling down. Against the US dollar, we are seeing a greenback comeback of sorts. The USD suffered from Trump’s health care failure but then recovered. Yet the pound is also falling against the euro.

Further support awaits at 1.2350, followed by 1.2250 and 1.21. Resistance is at 1.2415 and 1.2540.

Here is how it looks on the chart: