The bounce that the pound enjoyed was never meant to last. There was a temporary breather and now GBP/USD is plunging once again.

Chief EU negotiator Barnier says that the negotiations about the UK’s exit from the EU have reached a deadlock over Britain’s divorce deal. While May’s Florence speech provided some momentum, the lack of clarity on the payment is frustrating.

Most importantly: he cannot ask the EU Summit to open talks on the future relationship. The EU continues treating the UK like Greece.

He also says that “no deal would be a very bad deal”, contrary to what British officials have said time and time again: that no deal is better than a bad deal. The EU is ready to face all eventualities and transition period agreement must respect the sequencing of issues agreed in the mandate.

His counterpart, David Davis, said that the “much work still needs to be done” in these Brexit talks. What about some details? They can later according to the Brexit minister. He added that he hopes that EU leaders will let Barnier explore transition periods with the UK.

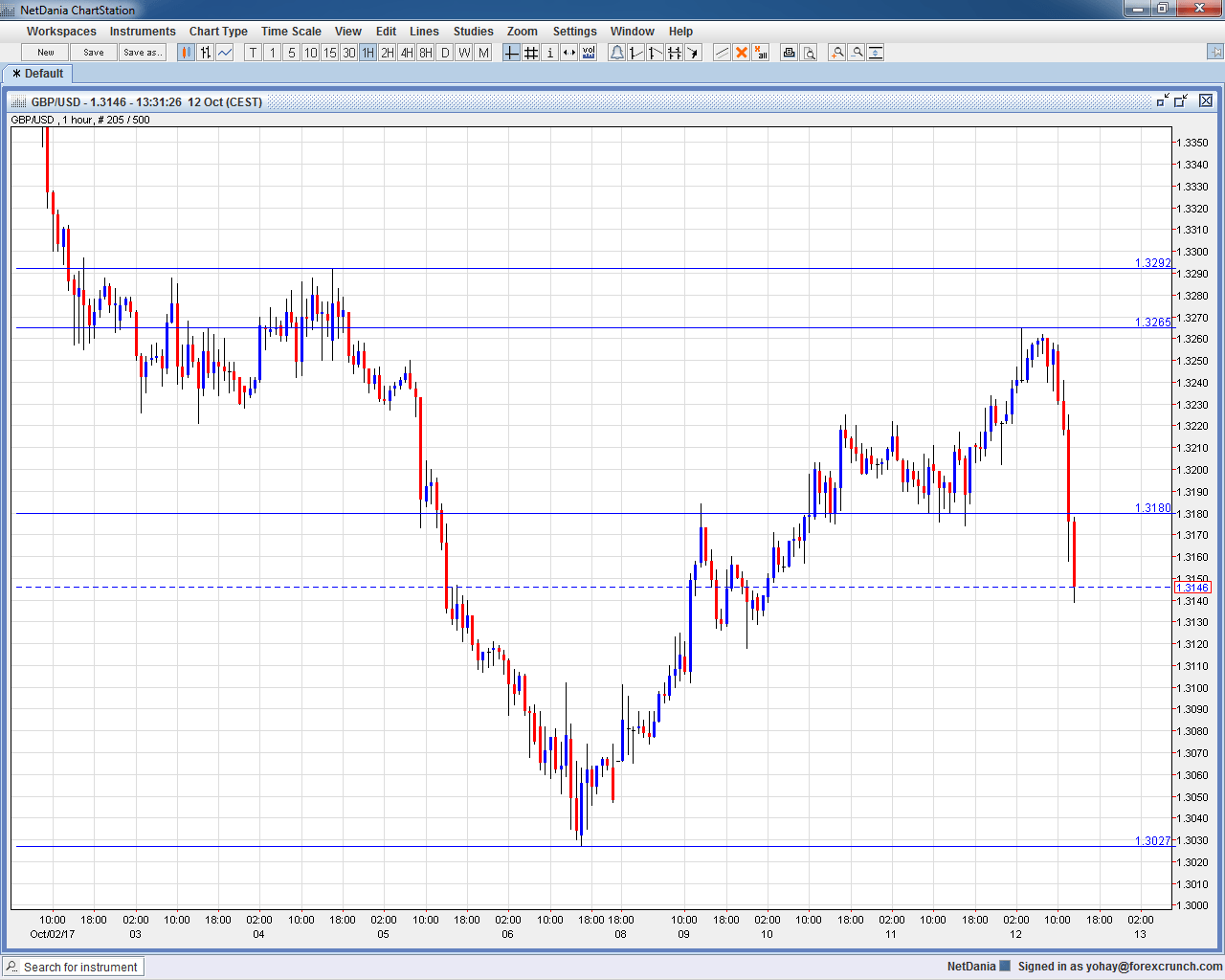

GBP/USD reached a high of 1.3265 earlier in the day and ticked a bit lower. From there, its losses accelerated and it now trades at 1.3145. Support awaits at 1.3030.