GBP/USD slipped from the highs amid Brexit worries and a strengthening of the US dollar. Has it peaked? The upcoming week features the PMIs as well as other indicators. Here are the key events and an updated technical analysis for GBP/USD.

Theresa May’s Florence speech continued reverberating through markets. A breakthrough in Brexit talks seems unlikely at the moment. UK GDP was downgraded on the annual level and also other figures such as the current account fell short of expectations. The US dollar gained some ground on hopes for a tax reform, among other reasons. Contrary to the UK, US GDP was upgraded. Other figures were more mixed.

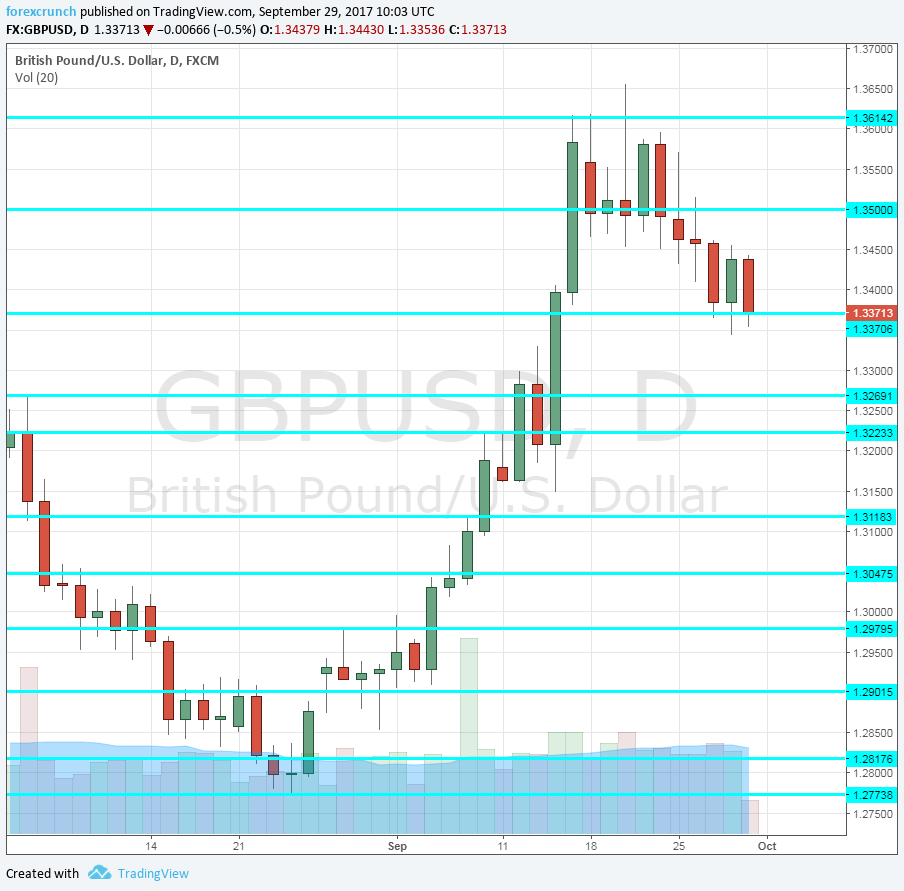

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The manufacturing sector is quite small but still meaningful. The fall of the pound made Briths exports more attractive. The manufacturing PMI stood at a strong 56.9 points in August.

- Construction PMI: Tuesday, 8:30. The construction sector is slowing down, with the PMI reaching a low of 51.1 points, barely above the 50 point threshold that separates expansion and contraction.

- FPC Meeting Minutes: Tuesday, 8:30. The minutes from the Financial Policy Committee’s meeting could provide more insight about the rapid growth in credit. The Bank of England is worried about growing debt among UK households.

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium has shown yearly drops in prices at its shops for quite a long time. Nevertheless, CPI is on the rise. The figure dropped by 0.3% in August.

- Services PMI: Wednesday, 8:30. The services sector is the largest in the UK and this PMI tends to have a significant impact on the pound. At 53.2 points in August, the indicator reflects moderate growth, or hesitance if you wish. It stood above 55 points earlier in the year.

- Housing Equity Withdrawal: Thursday, 8:30. The change in the value of mortgages that are not used for homes has been dropping and reached a negative 10.4 billion in Q1 2017. We now get the figure for Q2.

- Halifax HPI: Friday, 7:30. This early indicator of home prices has shown a rise in August: 1.1%, beating expectations. A slowdown in housing is closely watched.

GBP/USD Technical Analysis

Pound/dollar struggled to hold onto the higher ground and extended its drops from the cycle highs of 1.3620 (mentioned last week).

Technical lines from top to bottom:

1.3830 was a trough that the pair experienced back in February 2016, before the Brexit vote. The very first low that the pair experienced after the vote was 1.3620.

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

The UK economy is not doing too well and Brexit talks are going nowhere fast. While the Fed is not really sure about raising rates, it still enjoys an advantage over the pound.

Our latest podcast is titled Euro troubles and golden opportunities

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!