GBP/USD extended its falls amid Brexit uncertainty and unimpressive economic data. Will it head below 1.30? The upcoming week features industrial output, the trade balance and more. Here are the key events and an updated technical analysis for GBP/USD.

Despite the feel-good atmosphere after May’s Florence speech, the headlines were much more negative now about Brexit. It seems that talks have stalled once again. The pound also suffered from a drop of the construction PMI to contraction territory and the notion that the BOE will note hike interest rates beyond November. Here are 4 reasons for the crash of the pound. In the US, data was mostly positive. although the Non-Farm Payrolls was skewed by the hurricanes, showing a drop of jobs but a big gain in wages.

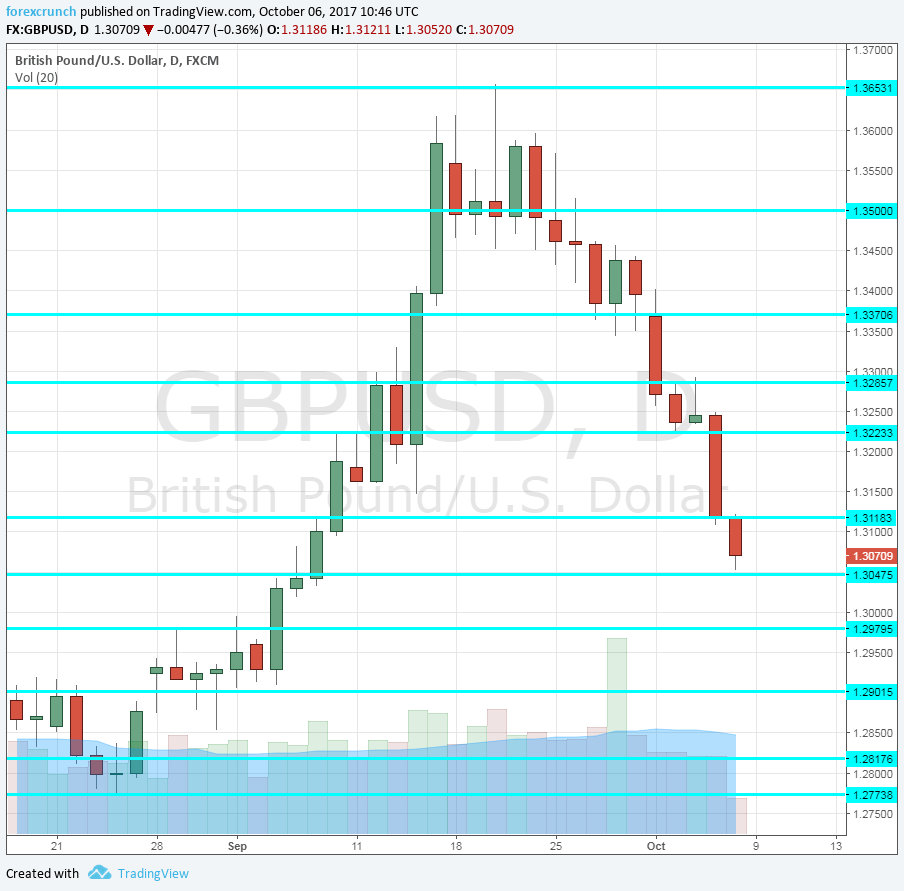

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:00. The British Retail Consortium has shown a rise in sales in the past three months, a positive sign after some worries beforehand. After an advance of 1.3% in August, perhaps we will see a slide in September.

- Industrial output: Tuesday, 8:30. While the UK economy leans heavily towards services, the industry still plays an important role. A rise of 0.2% was seen in industrial production back in July. The narrower manufacturing production advanced by 0.5% and is now expected to rise by 0.3%.

- Goods Trade Balance: Tuesday, 8:30. Britain suffers from a trade deficit, which has worsened in the past year. A deficit of 11.6 billion was recorded in July. A similar deficit is on the cards now: 11.2 billion.

- Construction Output: Tuesday, 8:30. The construction sector is suffering from contraction according to the latest PMI by Markit. It will be interesting to see if we will see another fall after -0.9% in July. A small rise is forecast now: 0.1%.

- NIESR GDP Estimate: Tuesday, 12:00. The National Institute of Economic and Social Research provides a running estimate of GDP. In the three months ending in August, it showed a growth rate of 0.4%, better than in previous months. We will now get the figure for June to September, which is exactly Q3.

- RICS House Price Balance: Wednesday, 23:01. The Royal Institution of Chartered Surveyors publishes a monthly diffusion index for the housing sector. It almost fell to the negative ground in July but bounced back to 6%. A small slide to 4% is estimated now.

- BOE Credit Conditions Survey: Thursday, 8:30. The Bank of England’s report on credit conditions is watched for rate hike assessments. If conditions are too loose, the BOE has higher incentives to raise rates.

- CB Leading Index: Friday, 13:30. This composite index uses 7 indicators, most of them already public. Nevertheless, it is of interest. A drop of 0.1% was recorded in July.

GBP/USD Technical Analysis

Pound/dollar struggled to hold onto the higher ground and extended its drops from the cycle highs of 1.3620 (mentioned last week). It then extended its falls.

Technical lines from top to bottom:

1.3830 was a trough that the pair experienced back in February 2016, before the Brexit vote. The very first low that the pair experienced after the vote was 1.3620.

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The previous 2017 high of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

The EU is treating the UK like Greece, and markets are getting to grips with this. In addition, the BOE is not really hawkish. Uncertainty about who will be in Downing Street could further weigh on the pound.

Our latest podcast is titled Good, bad and ugly NFP, Catalan crisis update

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!