Theresa May finally laid out her Brexit strategy. Her speech was full of pleas for unity, strength, and partnership but markets were focused on other things in her wide-ranging discourse. GBP/USD, that was on the rocks ahead of her appearance, leaps nearly 200 pips from the lows. This is not a move that is seen every day.

Here are three reasons for the rise:

- Buy the rumor, sell the fact: The Sunday Times published the plans to exit the single market already on Sunday and the pound collapsed on Monday. Blue Monday belongs to the past. May’s admission about this only confirmed the news. This is a classic “buy the rumor, sell the fact”.

- Vote in parliament: MPs and also the Lords will get the opportunity to scrutinize the Brexit deal and eventually approve it. Markets have some hope that this could at least soften Brexit. The ruling by the high court helped the pound in the past. A Brexit that is less straightforward is better for markets.

- Phased implementation: While Breixt means Brexit and May wants to reach a deal within the two-year period that Article 50 sanctions, she talked about a longer implementation. This is also a softer deal that would make the transition smoother and reduce the shock.

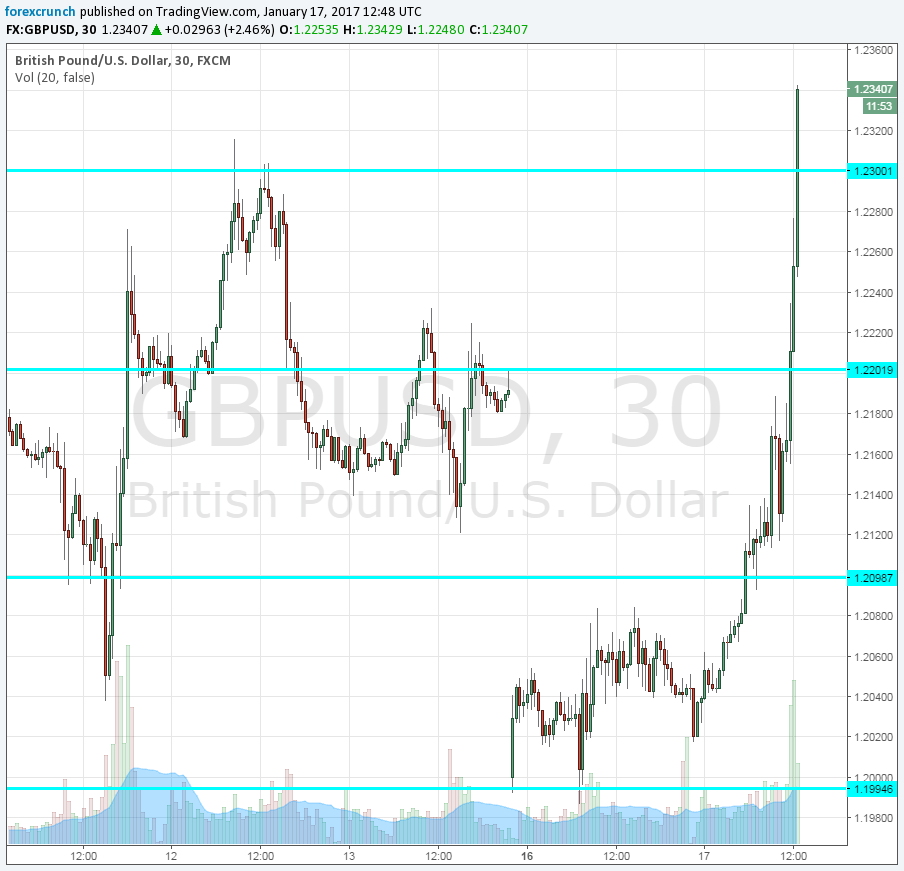

GBP/USD was trading around 1.2170 before the publication and has already reached 1.2346, a leap of 170 pips. The daily range is even wider: from 1.2017 to 1.2346 is a solid 300+ pip daily range, something not seen that often.

Cable closed the Sunday Gap on that Times report. The next level to watch is 1.2380, followed by 1.25. Support awaits at 1.23.

More: GBP: A ‘Tricky’ Start For 2017: 2 Major Risk Events Ahead – Credit Suisse

Here is the chart: