Currencies have moved quite a bit after the Easter holiday. GBP/USD reached new lows and USD/CAD fluctuated quite a lot.

The team at SocGen analyzes the technical charts and provides interesting analysis:

Here is their view, courtesy of eFXnews:

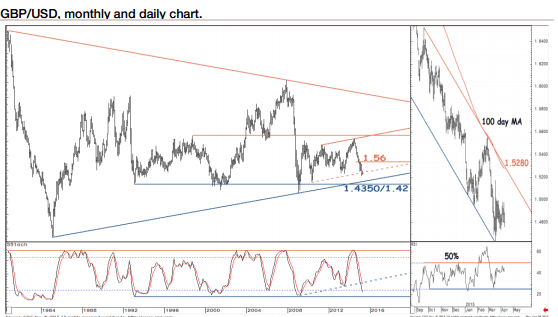

GBP/USD violated the multi-year upward channel last month, confirming the possibility of an extension in the downtrend, notes SocGen.

“The monthly indicator has also breached a similar trend line, which gives credence to a price break. The pair looks poised to decline towards the graphical support at 1.4350/1.42, also the 76.4% retracement of the 2009-2014 up move,” SocGen projects.

“In the short term though, GBP/USD appears to be undergoing a sideways configuration. The daily RSI is under the graphical level of 50%, suggesting that the recovery is of limited nature and should be confined to the 100-day MA at 1.5280,” SocGen adds.

Moving to USD/CAD, SocGen notes that its uptrend has paused since January.

“The monthly indicator has tested a multiyear graphical ceiling, suggesting consolidation. In the short term, the pair is evolving within a (nearly) horizontal channel between 1.24/1.2365 and 1.2850. The daily RSI is testing a multimonth support, indicating that the phase of consolidation is likely to persist,” SocGen projects.

“In the event of a break below 1.24/1.2365, USD/CAD will face a deeper correction towards 1.23 and probably even towards the monthly channel limit at 1.20,” SocGen adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.