GBP/USD managed to close the week on higher ground for a change. What’s next? The Services PMI stands and also Brexit negotiations are expected to warm up. Here are the key events and an updated technical analysis for GBP/USD.

The pound was driven mostly by the crisis in Italy that hit the euro and took the pound down with it. A flight to safety did not help Sterling. In the UK, the manufacturing PMI came out slightly above expectations at 54.4 and that helped the recovery. In the US, the Non-Farm Payrolls report beat expectations with a gain of 223K and a rise in wages of 0.3% MoM.

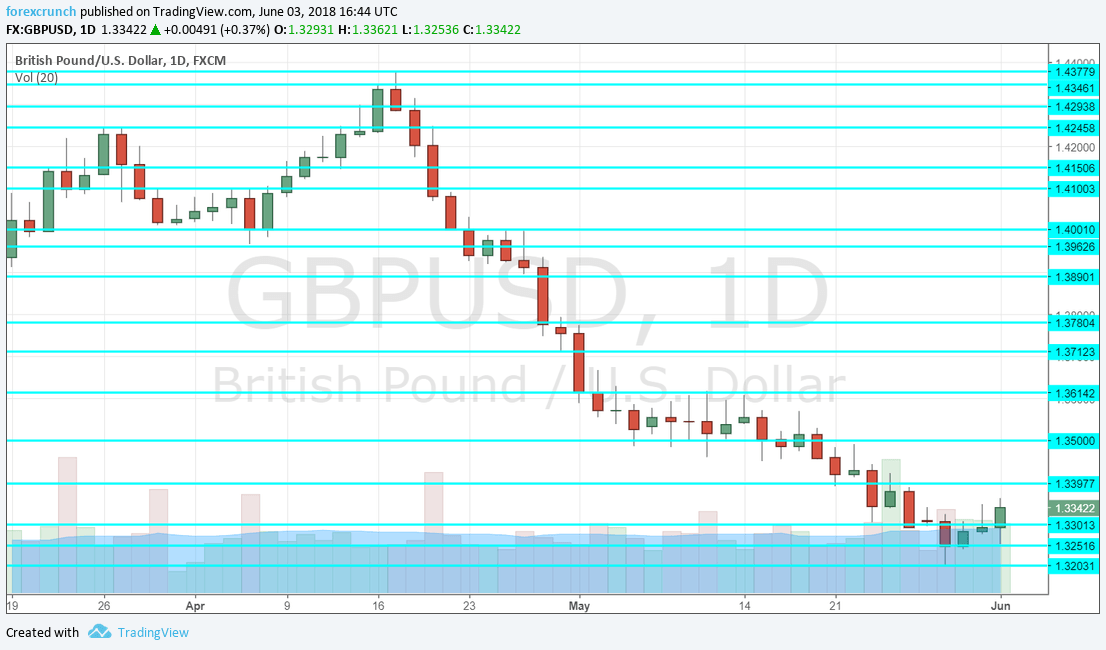

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Construction PMI: Monday, 8:30. The second purchasing managers’ index of the week comes from the more volatile construction sector. A bounce back to 52.5 was seen in April, reflecting modest growth. A small slide to 52 is on the cards.

- Silvana Tenreyro talks: Monday, 17:00 and Wednesday, 10:40. The External BOE MPC member will speak on two occasions. She is relatively new at the Monetary Policy Committee and her twin appearances will shed some light on her views. There is a small chance they will vote to raise rates in August, but November seems more likely.

- BRC Retail Sales Monitor: Monday, 23:01. The gauge from the British Retail Consortium has shown a big year over year drop of 4.2% in sales back in April. This may have been a result of the early Easter and we may see a better level now.

- Services PMI: Tuesday, 8:30. The last purchasing managers’ index published in the UK is also the most important one, for the services sector, Britain’s largest. The score disappointed in April with 52.8 points, still reflecting a modest growth rate that spills into the second quarter. The figure for May is published now. A drop to 52.9 is on the cards.

- Jon Cunliffe talks: Tuesday, 10:00. The Deputy Governor has expressed a dovish sentiment in the past. Any deviation from these views may boost the pound. Cunliffe retires later this year.

- Ian McCafferty talks: Wednesday, 16:00. This external MPC member will talk on radio. Contrary to Cunliffe, McCafferty has expressed hawkish views. A turn to the dovish side may weigh on the pound. He will retire in August.

- Halifax HPI: Thursday, 7:30. This is one of the broadest House Price Indices available in the UK. It has shown a bit drop of 3.1% in prices in April and is forecast to show a bump up of 1.1% in May.

- David Ramsden talks: Thursday, 15:00. The last MPC member to speak is a relatively new one, less than a year in the job. He is closer to the middle and his views have moved markets in the past.

- Consumer Inflation Expectations: Friday, 8:30. The BIE’s survey of around 2000 consumers resulted in an annual inflation rate of 2.9% in the past two quarters. A slide may be seen in the publication for Q1 2018.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar dropped to new lows close to 1.32 but recovered and ended the week above 1.33.

Technical lines from top to bottom:

1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Below, 1.3615 capped the pair in late 2017. The round number of 1.35 was a pivotal line within the higher range.

1.3460 was a swing low in early 2018 and remains relevant. The round number of 1.34 could provide further support.

Further down, 1.33, which supported the pair in December, is still relevant and the break is not yet confirmed. 1.3250 was a swing low in early June.

Even lower, was the low point in late May. 1.3080 served as support back in November 2017. The ultimate line is 1.3000.

I remain bearish on GBP/USD

Brexit negotiations may see the EU and the UK in loggerheads over the Irish border and it could risk the full deal. In addition, the economy is not doing that great and the US dollar remains strong.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!