The British pound managed to stabilize after the big flash crash, but hasn’t taken full advantage of the dollar’s pre-election slide. But will the Bank of England unleash sterling’s potential?

Here is their view, courtesy of eFXnews:

GBP: BoE’s Carney To ‘Talk Up’ GBP On Thursday – Credit Agricole

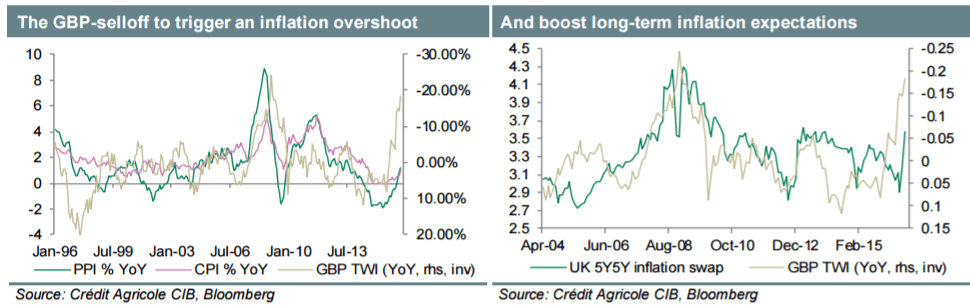

This week’s inflation report will attract considerable attention with investors keen to know how the growing risk of stagflation in the UK (eg, weak growth and soaring inflation) will affect the bank’s policy outlook.

We suspect that the MPC will revise its inflation projections to the upside while revising its annual growth projections for 2017 down (in part to account for the stronger economic performance since the EU referendum). The projections need not point at imminent stagflation, however.

In addition, we suspect that the MPC will want to convey the message that they are still able and ready to ease again if needed. Even so, the Governor will also highlight that any surge in inflation, on the back ‘substantial’ FX depreciation, can severely limit the bank’s ability to respond to future economic shocks.

We believe that Carney will use the IR conference to talk up GBP and highlight that the prospect for any future easing will depend upon the future path of the currency. This could help support GBP if only because it will be seen as delaying future BoE easing.

Needless to say, this can only be positive for GBP so long as investors do not think that the UK economy needs further stimulus.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

GBP: 3 Reasons For An Extended Squeeze Of Short Positions – BTMU

While October was certainly a month for the ‘hard’ Brexit camp and GBP bears, we are unconvinced that the negative pound sentiment on ‘hard’ Brexit will prove sustainable. So we are maintaining our forecasts of a pound rebound going forward.

In this sentiment driven market, some positive factors are being ignored and at some point could well spark a sizeable squeeze of short GBP positioning.

Firstly, the most obvious is the resilience of the economy and this is perhaps the biggest surprise post-Brexit. Real GDP data confirmed much stronger than expected growth in Q3 of 0.5% in contrast to the BoE’s expectations of just 0.2% growth.

Secondly, fears of a ‘hard’ Brexit in the financial markets don’t appear to be reflected in the real world! Nissan announced in October that it would increase investment in its plant in Sunderland to increase production planned in 2019. Nissan apparently received assurances (denied by No.10) from the government of continued favourable trading with the EU. If true what is being planned?

Finally, Gilt yields have risen relative to yields elsewhere. This may reflect foreign investor selling but equally, yields now on offer reduce current account financing risks going forward. The pound should also derive some support from the likelihood of a shift in stance from the BoE. There now appears little justification for the additional monetary easing that was signalled by the BoE as likely to be implemented before the end of this year. There remain some downside risks for the pound related to the invoking of Article 50. However, risks are skewed with any court judgement in favour of parliamentary consent being required triggering a larger upside GBP move than vice versa.

While sentiment could still drive the pound further weaker, we see recent positive developments as reason to forecast some pound recovery going forward.

BTMU targets GBP/USD around 1.2490 by year-end.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.