The British pound has reached new 31-year lows against the US dollar. But this may not be over. Here are 3 opinions seeing more room to the downside:

Here is their view, courtesy of eFXnews:

1. GBP: Further Weakness Short-Term On Bearish Technical Signals – BTMU

The pound has come under renewed selling pressure early this week which has resulted in the trade-weighted pound falling to new cyclical lows. The break of key technical support levels has reinforced the pound’s renewed downward momentum.

The lows for the pound during the initial aftermath of the Brexit vote from early in July have been taken out as cable has broken below support at just below the 1.2800- level and EUR/GBP has rose above resistance at the 0.8725-level.

It provides a bearish technical signal that the pound is likely to weaken further in the near-term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

‘Hard Brexit’: Staying Bearish GBP Even After Reaching Our 1.28 Target- BNPP

Prime Minister May’s indication at the weekend Conservative party conference that the UK will invoke Article 50 of the EU Treaty by the end of Q1 2017 seems to have refocused markets on the considerable uncertainty that lies ahead. In her comments she rejected the notion that the UK could select an existing model, such as Norway or Switzerland now employ, and stressed that a unique relationship with the EU would be negotiated.

Our economists note that the position may add to concerns about the possibility of a hard Brexit given the difficulty of reconciling controls on immigration with full access to the single market. Meanwhile, in separate comments, the UK Chancellor appeared to rule out significant fiscal stimulus to smooth the transition, leaving the economy reliant on further BoE easing if data begins to slow again.

We remain broadly bearish on the GBP even after reaching our 1.28 target in GBPUSD.

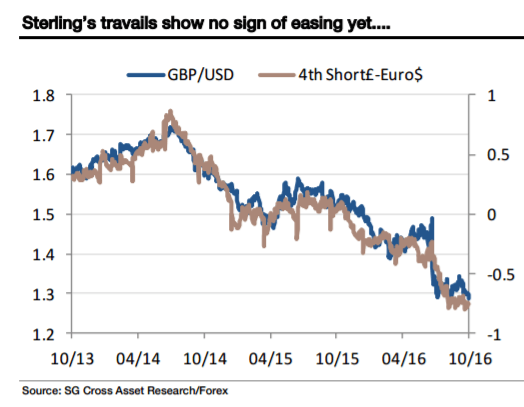

GBP: Sterling’s Travails Show No Sign Of Easing Yet; Staying Short – SocGen

Confirmation that the UK Government plans to trigger article 50 by the end of Q1 2017 hit sterling harder than I expected yesterday, which given how much time I have spent blathering on about the risks to the pound is saying something. Some sort of a bounce is possible today but the noises from the Conservative party conference aren’t helpful. There will be fiscal slippage as the Chancellor won’t try to hit previous deficit reduction targets, but a significant easing is not on the cards. Nor is the government showing any signs of shifting a position where control on immigration is the hardest of lines in negotiations to leave the EU, and won’t be sacrificed or watered down in order to keep access to the single market, particularly for financial services. There’s nothing there to soften the outlook for sterling, at all.

f I extrapolate the correlation between GBP/USD and rates, GBP/USD 1.25 is reached if the market prices a 12-month forward rate differential of 1%. That will happen as long as the Fed is on track to raise rates at least twice by the end of 2017, and the UK is on track to ease at all. To get sterling below 1.20 we need the market to price much more Fed hiking, or the UK economy to be in poor enough shape that these simple rate/FX correlations break down. For now, our base case is still for a low of GBP/USD 1.23 in March.

*SocGen maintains a short GBP/USD position from 1.3750 targeting 1.25.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.