The Sterling continued its decline against the greenback for a sixth straight week, closing last Friday near 1.2580. Brexit chaos continues to drive the Pound lower, and last week’s party leadership challenge of PM May has damaged her authority even further despite successfully warding off her own party’s no-confidence vote. Several weeks of distractions and skirmishes have failed to distract from the fact that PM May’s current Brexit proposal stands no chance of passing in parliament, and further concessions by the EU have likewise been ruled out. PM May continues to seek further reassurances over the Irish backstop proposal, but EU leaders in Brussels are refusing to go outside of whatever’s already been written within the current divorce proposal.

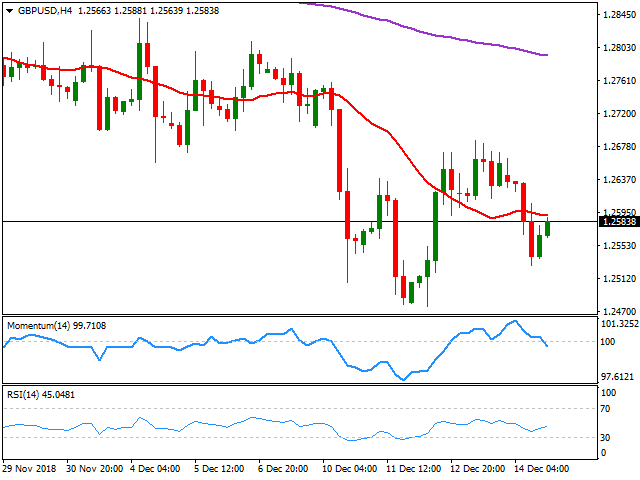

The GBP/USD pair bottomed at 1.2479 last week, its lowest since April 2017, bouncing up to 1.2686 after PM May survived to the no-confidence vote, resuming its decline afterwards. The mentioned high was way below the weekly one at 1.2759, indicating that market players still see recoveries as an opportunity to sell. According to the daily chart, the bearish trend is set to continue, as the pair is developing well below its 20 DMA, which extends its slump below the 200 EMA, while technical indicators resumed their declines within negative levels after a modest bounce from nearly oversold readings. In the 4 hours chart, the price settled below a directionless 20 SMA, while technical indicators hold within the bearish ground, the Momentum heading lower and the RSI hovering around 45, all of which maintains the risk skewed to the downside.

Support levels: 1.2545 1.2510 1.2475

Resistance levels: 1.2620 1.2665 1.2700