The UK will soon trigger article 50 and trigger a 2-year countdown towards the exit doors from the EU. One option that is always on the cards is a transition deal. What does this mean?

Here is their view, courtesy of eFXnews:

Applying ‘game theory’ to the transition.

Using game theory, we determine the conditions that make it rational for the UK and the EU to reach a transition agreement to allow time for a final trade agreement. There are some advantages to end the game sooner, without a transition, as waiting is costly. However, two frictions make the transition attractive: a UK-EU trade deal needs time, and players have different preferences over trade and labor policies. Waiting for the final trade agreement without a transition would be costly, as the WTO rules make both players worse off. Still, the players are comfortable with a small risk that the negotiations fail and the WTO rules apply, as long as compromise is more likely.

We show that the transition period provides time to strike the right balance between the labor market and trade policies, given the different preferences in the UK and the EU. In equilibrium, the players delay finalizing an agreement on the labor market, until a fleshed–out trade deal is struck. This achieves an optimal split on policies while paying a cost of delay as trade negotiations could also break down. Of course, this is just a theoretical model; the reality could be more complicated and usually includes more decision trees.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

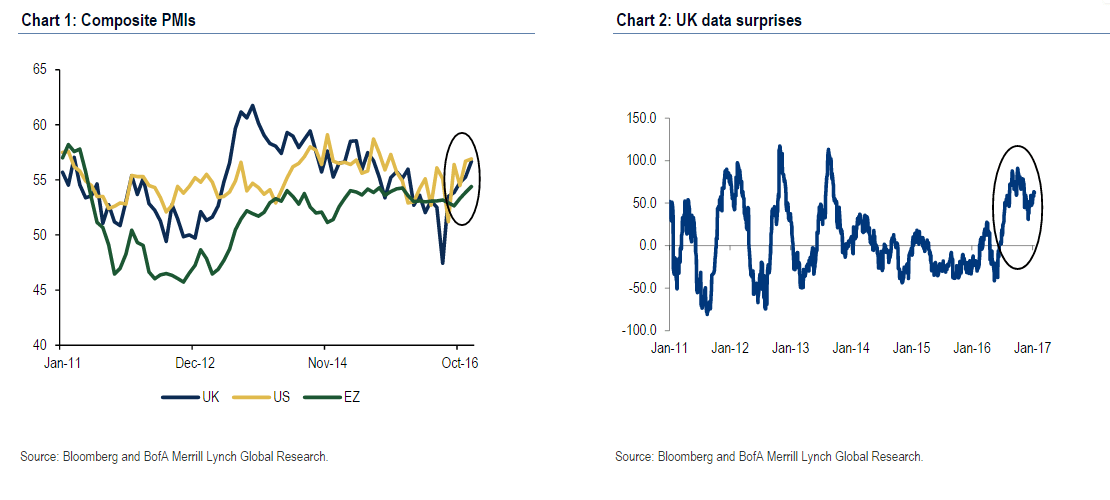

Our analysis suggests that GBP/USD could appreciate well above 1.30 if there is a transition, but could weaken as far as 1.10 if there is not. The growing consensus in the UK on the need for transition, or at least an implementation phase, has supported GBP recently. However, markets could also be disappointed. We are long GBP/USD vol.

Agreeing on a transition could take time, but a tacit acceptance of the need for it could suffice for FX markets. We discuss possible scenarios, but our bottom line is that politics and the public opinion will determine whether or not there is a transition and whether it will be long enough. We would expect rationality to prevail. This is one of the reasons why we are constructive on GBP in the medium-term after one more dip lower following activation of Article 50 in Q1. However, politics don‘t always lead to optimal outcomes.