The German locomotive is firing on on all engines. The economy of the largest economy grew by 0.8% q/q in the third quarter of 2017, significantly better than 0.6% predicted and an excellent number on its own. Year over year, growth is at 2.8% on the WDA and 2.3% on the NSA, both exceeding expectations.

EUR/USD is ticking higher ahead of the European open. Will it extend its gains afterward?

Germany’s final inflation figures confirmed the early estimates: 1.5% y/y on the European standard HICP. Month over month, prices dropped by 0.1%.

Germany was expected to report a quarterly rise of 0.6% in its economic output in Q3, repeating the same increase seen in Q2. Germany is the largest economy in the euro-zone and hasn’t published its data yet.

The initial figure for the 19-country currency bloc has already released an initial estimate which came out at 0.6%. The number will be updated later today with the figures from both Germany and also Italy, the third-largest economy.

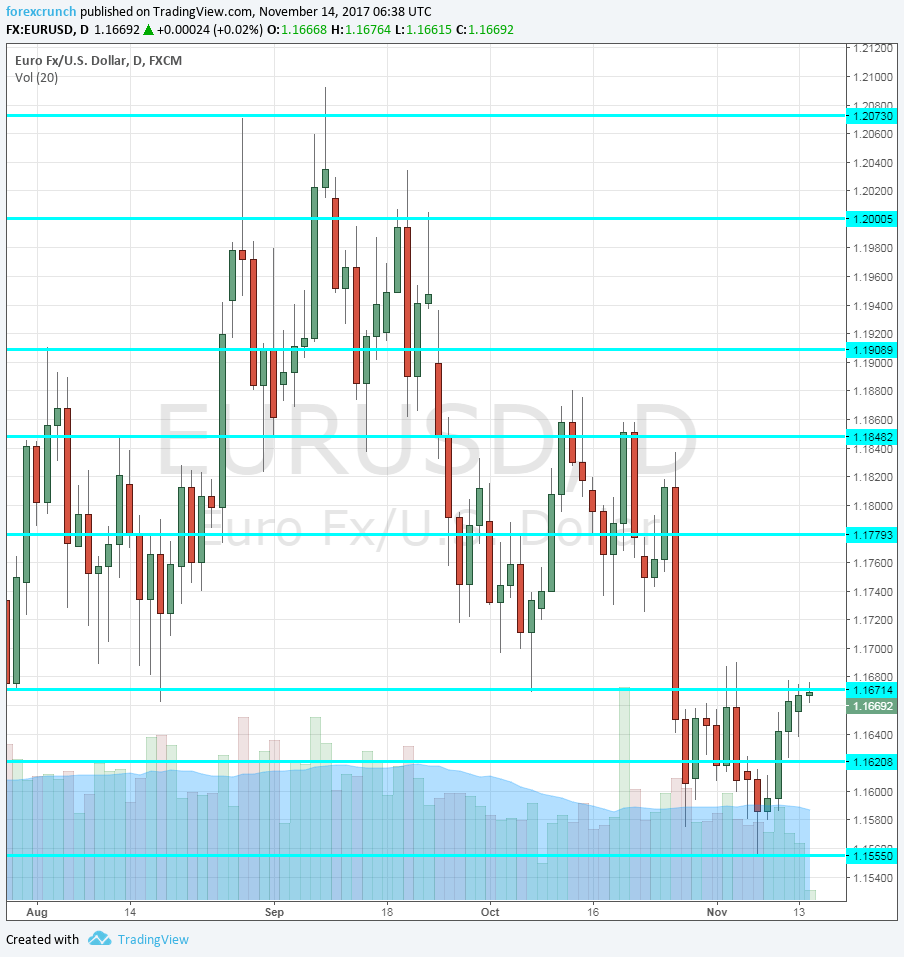

EUR/USD was trading quite steadily at the 1.16 handle which is likes of late, and rose to higher ground. It flirted with resistance around 1.1670. Further resistance awaits around 1.1780. Support is found at 1.1620, followed by 1.1555.

Later today we will hear from ECB President Mario Draghi, which is hosting a conference in Frankfurt.