Germany’s No. 1 Think-Tank shows strong growth in the continent’s locomotive. A score of 112.3 is beyond expectations of 111 points.

In a separate report, the euro-zone M3 Money Supply is up 4.7%, a bit under expectations for 4.9% while the volume of private loans advanced by 2.3%, an acceleration in comparison to 2.2% that was seen beforehand.

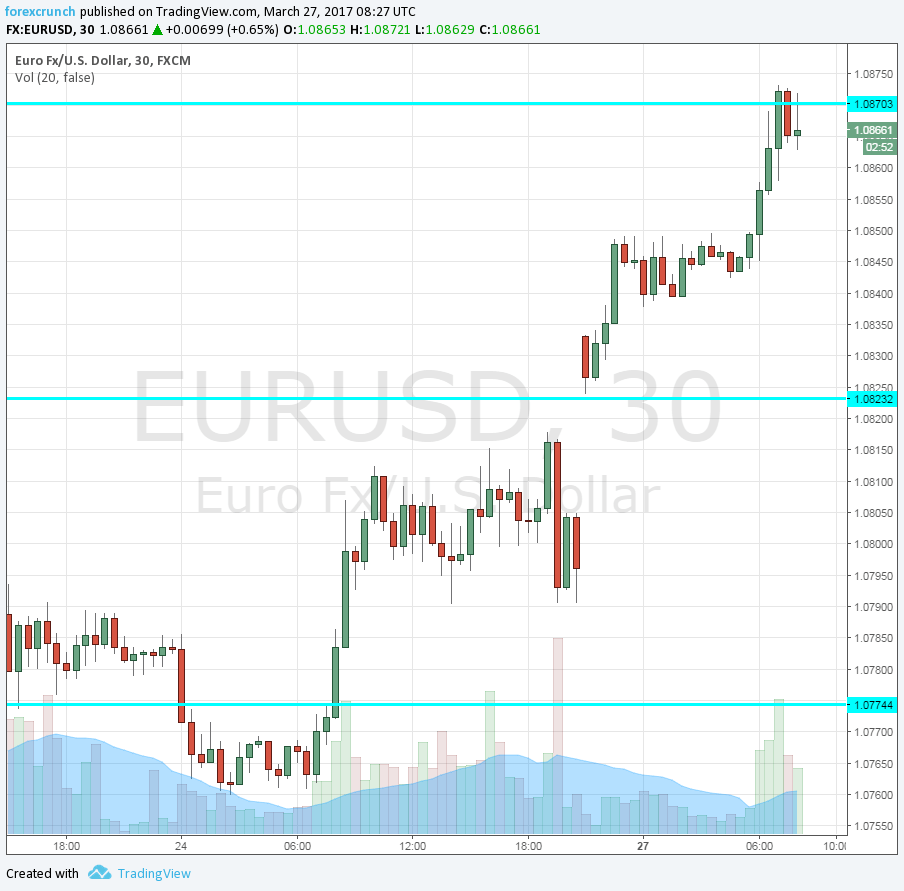

EUR/USD holds onto high ground but seems to struggle with the 1.0870 level.

The German IFO Business Climate was expected to remain unchanged at 111 points for the month of March. The indicator saw a dip in January but bounced back to 111 in February. The business expectations component was predicted to rise from 104 to 104.3. The Current Assessment carried expectations for a small tick lower: 118.3 from 118.4 points.

EUR/USD was on a roll ahead of the publication, trading around the December 2016 high of 1.0870. Further resistance awaits at 1.0960. Support is at 1.0830.

The euro received some backwind from Angela Merkel’s victory in Saarland, reinforcing her hopes of being reelected and showing that mainstream parties are still dominant in Germany.

The euro previously enjoyed some hawkish comments from the ECB. The central bank is considering raising the deposit rate ahead of ending the QE program.

The US dollar suffered from Trump’s failure to get a vote on healthcare. The debacle lowered expectations for fiscal stimulus down the road. In addition, the Fed’s “dovish hike” still echoes and weighs on the greenback.

More: EUR/USD at the 2017 highs – where next? 4 opinions