So maybe Brexit is problematic after all? Germany’s No. 1 Think Tank surprised with a drop in business confidence. The headline business climate figure fell from 108.3 to 106.2, below expectations for a modest slide. The Current Conditions component also slipped from 114.8 to 112.8. The Expectations figure missed expectations with a drop from 102.1 to 100.1.

It is also interesting to see that ZEW and IFO are going in a separate direction. The ZEW indicator for July showed a shock: a drop to the negative ground due to Brexit. It later recovered. On the other hand, IFO stood its ground in July but is falling now. IFO usually has the upper hand. Will it eventually hit the euro? Not so fast.

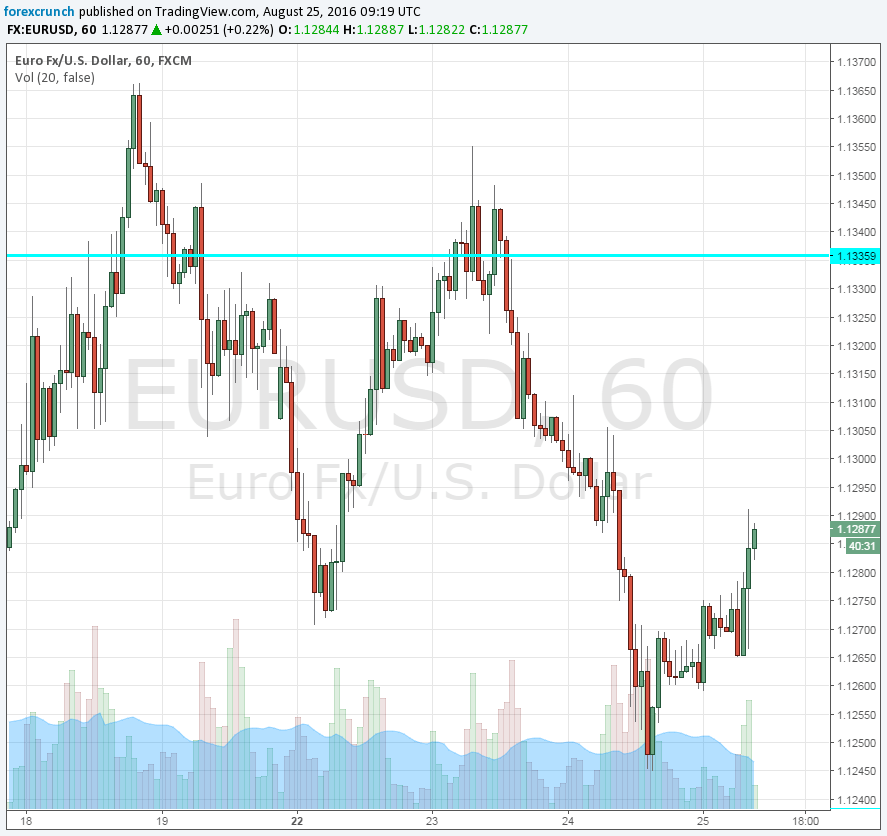

EUR/USD did not take too much note of the publication and is ticking a bit higher. The pair trades at 1.1286. EUR/USD already had its slide from the highs earlier in the week but bounced off the 1.1240 level.

Tension is growing towards the Jackson Hole Symposium. Fed Chair Yellen delivers her speech tomorrow at 14:00 and markets are waiting to hear if she has anything other than dovish to say.

Update: Indeed, Brexit is cited as a reason for the slump, while Turkey’s coup attempt is dismissed.