EUR/USD ended the month of February with a low close below under 1.12, the lowest in many years.

Does the pair have more room to fall? The team at Dankse calls for the next lower and provides 2 reasons:

Here is their view, courtesy of eFXnews:

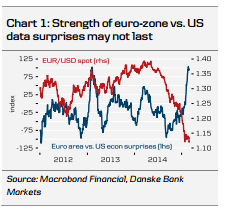

EUR/USD has been remarkably stable since the sell-off on the ECB’s QE blast but on Thursday the batch of strong US data sent the cross sharply lower, now trading just around the 1.12 level. Outperformance of the euro-area data surprise index relative to its US counterpart recently has seemingly kept EUR/USD from falling further.

We call for a next leg lower in EUR/USD in coming weeks. The reason for this is twofold.

First, the market should now be ready to gear up for the next step in the Fed’s path to tightening policy: this week’s testimony from Fed chairman Janet Yellen suggests that the wording regarding Fed being ‘patient’ in normalising rates will be taken out in March, leaving the Fed with the flexibility to hike rates either before or immediately after the summer (we call for a first hike in June. We see potential for a strong US payrolls report next week to trigger a next move higher in USD crosses. We think the market will buy into our argument that the Fed is growing more and more impatient and eager to normalise policy. Albeit a removal of “patient” should be seen merely as a necessary – rather than a sufficient – condition for the Fed to hike, the re-pricing of the US yield curve (level and slope) will arrive ahead of the actual hike and is thus a story for the 3-6M horizon in our view if past cycles is anything to go by.

Second, the ECB is due to initiate QE buying in early March and, although a lot of details on this are already out, we believe some markets has yet to factor in the full scale of this. One thing is the direct demand effect of the ECB emerging as a new marginal buyer, which should keep bond yields suppressed. Another is the so-called ‘hot potato’ effect: the combination of rising excess liquidity and negative deposit rates will drive investors towards riskier assets in a search for yield. Crucially, this search should also include nonEUR assets and thus drive some EUR selling. Moreover, in light of the strong European equity market performance since New Year some portfolio rebalancing could also be due on a 3M horizon according to our equity strategists. Next week’s ECB meeting is likely to focus on the details of the QE scheme and be a first step towards investors shredding EUR assets.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.