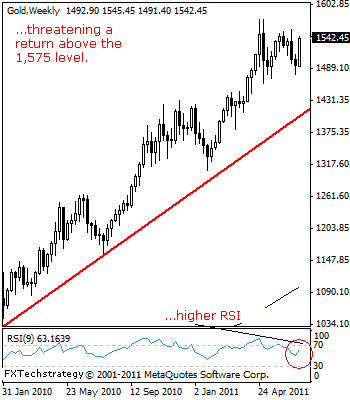

GOLD: Rallies, Risk Builds On The 1,576.20 Level

GOLD: The commodity reversed almost all of its two week losses to close strongly higher the past week.

This new development now leaves further upside risk targeting its psycho level at 1,600 and then the 1,650.00 level. Its weekly RSI is bullish and pointing higher supporting this view.

Alternatively, the commodity will have to break and hold below the 1,477.85 level to reverse its present bull pressure and bring further declines towards the 1,462.15 level, its May 05’2011 low.

Guest post by www.fxtechstrategy.com

Further down, support lies at the 1,405.00 level, its long term rising trendline. A halt in declines may be seen there thus turning Gold higher in the direction of its primary trend.

All in all, Gold has halted its declines and triggered a strong rally suggesting a push further higher in the new week.

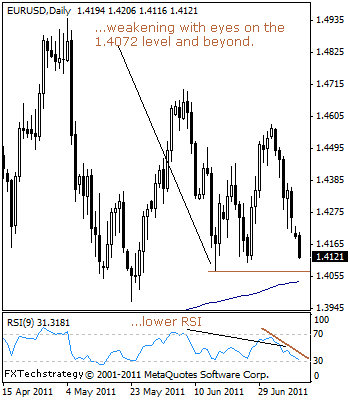

EURUSD: Follows Through Lower, Set To Weaken Further

EURUSD: With a follow through lower on the back of its past week gains now underway, risk of further declines towards the 1.4072 level, its Jun 16’2011 low is expected.

On a decisive break and hold below the 1.4072 level, further weakness will shape up towards the 1.3968 level, its May 23’2011 low . Further down, support lies at the 1.3900 level, its psycho level.

Its daily RSI is bearish and pointing lower supporting this view. On the other hand, the pair will have to climb back above the 1.4578 level to reverse its present bear pressure and then target the 1.4696 level, its Jun 07’2011 high.

Further out, the 1.4938 level, its 2011 high comes in as the next upside objective. All in all, EUR’s immediate bias remains to the downside having held on to its bearish tone set from the 1.4578 level.