- USD: Non-manufacturing ISM is the only major release today – if above expectations, the dollar may climb further – (see how to trade the event with EUR/USD) Focus will also be on presidential election – latest polls confirm a very tight race, although super-storm Sandy seems to have given Obama a minor boost.

- EUR: Spanish unemployment is the only major release out today, ahead of a myriad of services PMI figures for the eurozone tomorrow. The former will confirm that the Spanish labour market remains dire, and as such could weigh on the single currency.

- GBP: Only PMI Services to watch today. Cable still stuck in a range, despite the wobbly euro, but looks likely to break lower before too long.

Idea of the Day

The major FX winners in response to the robust payrolls figures were the dollar and high-beta currencies such as the Aussie. In contrast, the Japanese yen continued to suffer and both the euro and the pound were under pressure. Also, the gold price was hammered, reaching a 2mth low of USD 1,680. The pecking order outlined above may well continue for the foreseeable future. After weeks of testing the 80 level without any real follow-through, the dollar index is now up above 80.5 and looks set to appreciate further. The Aussie looks resilient, while both the yen and the euro look susceptible, as does gold.

Latest FX News

- USD: Healthy payrolls resulted in a decent pop to the topside for the dollar. Probably more to come, although will depend on outcome of tomorrow’s presidential election. A Romney victory would probably help the dollar, an Obama win would likely see some profit-taking.

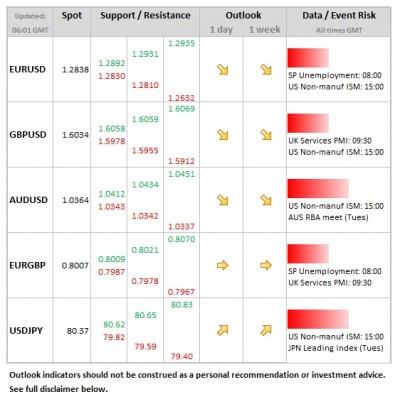

- EUR: Tough day on Friday, with some critical support levels busted. Higher Spanish bond yields did not help, nor did continuing concern re Greece. Still, the 1.28-1.32 range remains intact, but only just.

- JPY: Continues to weaken against the dollar and the Aussie, with Japanese exporter-selling prominent. Corporate Japan seems to be cratering, especially the electronics sector, and so a weaker currency is necessary.

- AUD: RBA Board meet tonight – market is 50/50 on a rate cut. Even if Stevens decides to follow-through with another cash rate reduction, not sure that the Aussie suffers too much. AUD still has plenty of friends.

- Gold: With both China and the US looking more robust, it is not surprising that gold is losing traction. We could well see gold fall to USD 1,600 before year end.