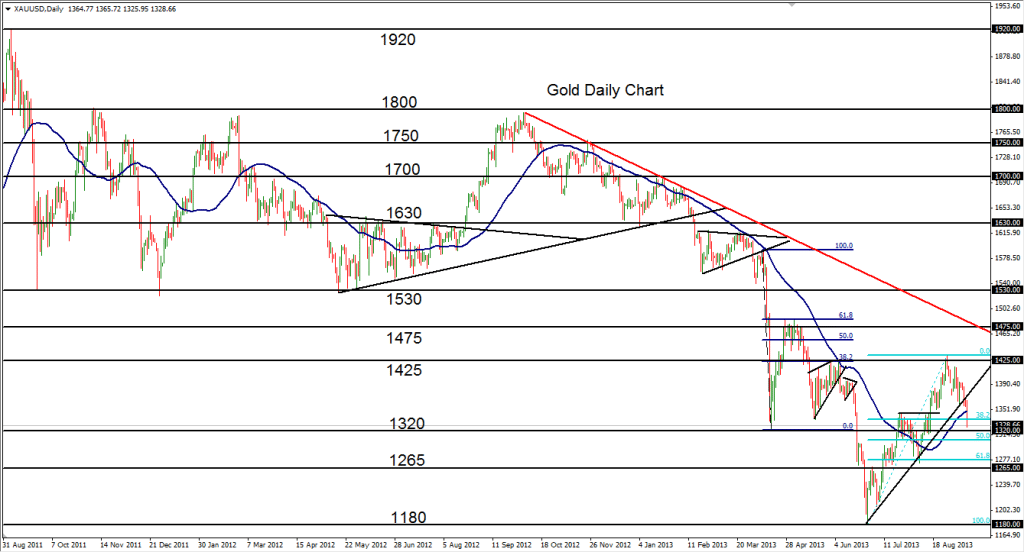

September 12, 2013 – Gold (daily chart) has fallen back down towards key support around the 1320 price region, establishing a new four-week low. This occurs during the course of two weeks of marked bearishness after the precious metal turned down from major resistance just above 1425 in late August. The potential recovery thus far lasted only for about two months, from the 1180 low in late June to the noted high in late August, before breaking down in the past two weeks. In the process of this drop, the price of gold has broken down below a key uptrend support line extending from that 1180 low, as well as tentatively below the 50-day moving average. Having just dropped down to dip towards the noted 1320 support level, the next major support target to the downside in the event of a further breakdown below 1320 resides around the 1265-1270 price area.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.